ISA Member and Industrial Leader Grainger released their Q2 Results on August 1st, which provided insight into their pricing actions and continued above market growth in their Endless Assortment business unit.

At this years, ISA Fall Summit Gowri Natarajan – Director Procurement & Supplier Management at Grainger will be speaking at the event. Our Channel Marketing Group team is looking forward to Gowri’s presentation and all the great Fall Summit presentations from the who’s who of Industrial Distribution in the three tracks at the ISA Summit in Memphis.

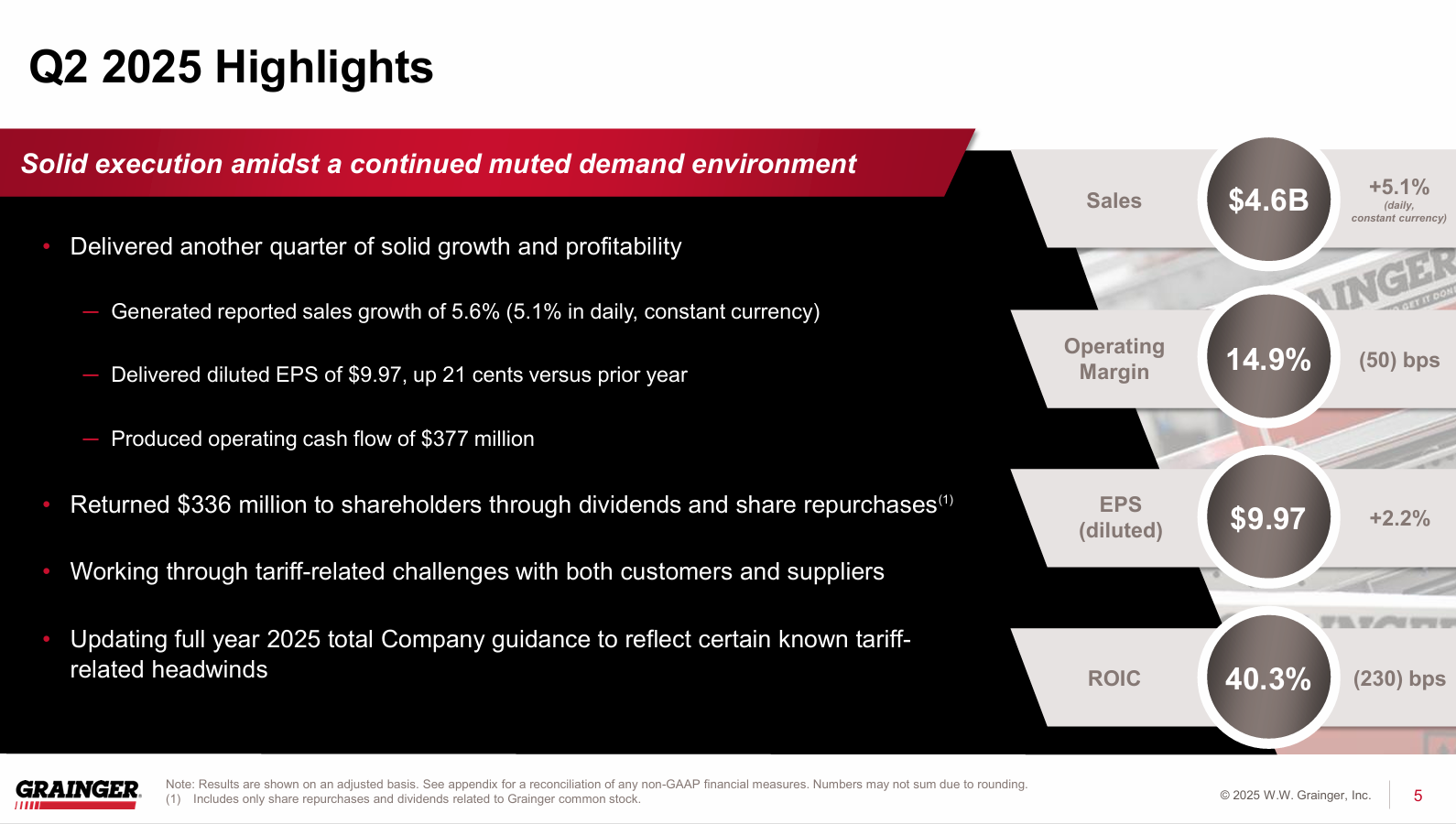

Grainger – the Lake Forest, Illinois industrial supply distributor, announced 2Q 2025 earnings on August 1. Sales increased 5.6% (reported and daily) to $5.4 billion, with growth in both segments. Gross profit margin decreased 80 bps due to pressure in High-Touch from tariff-related impacts, including LIFO inventory valuation headwind, to 38.5%. There was some segment mix drag from Endless Assortment growth. For the first time in quite a while, Grainger’s performance was viewed as disappointing by investors, primarily centered around profitability and future outlook for growth and margins.

Regarding tariffs, Grainger noted it took initial pricing actions in May with increases on products the company directly imported. Grainger noted that it is taking additional pricing actions in September on direct imports and supplier-imported products where cost negotiations are final. The company expects further tariff-driven headwinds in 3Q. As a result, they narrowed their full-year 2025 outlook, increasing sales guidance from 2.7% – 5.2% in May to 4.4% – 5.9% in August. Margin expectations took a slight haircut. The revision reflects confidence in top-line strength but also margin pressures from tariffs and cost inflation.

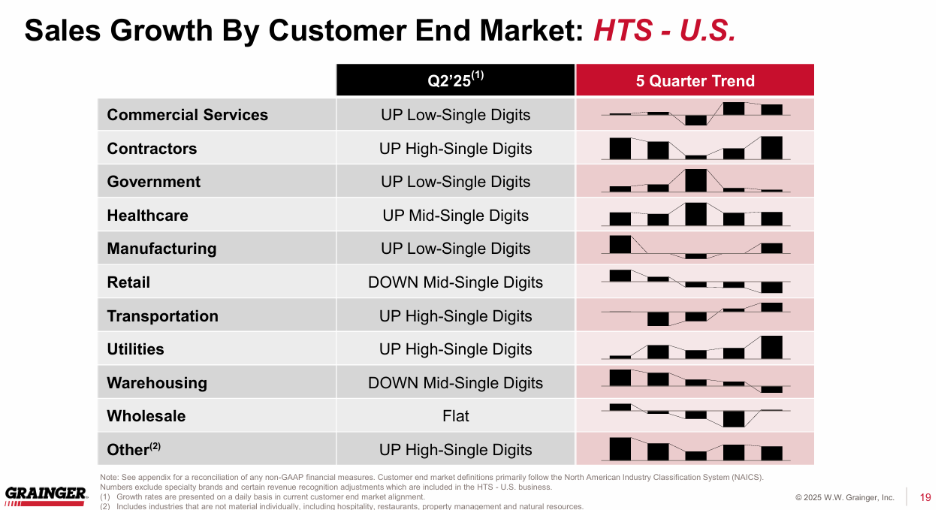

The outlook by end market from the earnings presentation:

The High Touch Solutions N.A. Segment had sales of $3.54 billion, up 2.5% year-over-year while with daily, constant currency-based sales increased 2.8%. Gross profit margin decreased 70 bps, driven y tariff-related inflation causing unfavorable price / cost timing and LIFO inventory valuation headwind, which was partially offset by positive mix and freight. Sequentially, margin was down 140 bps from 1Q.

The Endless Assortment Segment had sales of $929 million, which increased 19.7% year-over-year. The more digital-focused Endless Assortment segment continues to outperform, partially offsetting challenges in traditional distribution

Daily sales at Zoro increased 20.0% year-over-year, and MonotaRO sales grew 16.4%. Gross margin of 29.8% increased 30 bps year-over-year and 20 bps from 1Q, with Grainger noting a continued benefit from strategic pricing actions. Operating margin of 9.9% jumped 200 bps year-over-year, including a 380-point spike at Zoro due to gross margin flow-through and top-line leverage

Some concerns around Grainger include the results of the Endless Assortment digital/e-commerce segment outperforming, the much larger High-Touch Solutions segment, which has seen margin erosion. The risk is that digital growth may not fully offset persistent margin pressure in the legacy business if current trends continue. This dilutes the profit impact of sales growth.

Additionally, tariff-related inflation is compressing margins, especially in aforementioned core High-Touch Solutions (North America) segment. These pressures were the primary reason for Grainger’s lowering its full-year guidance, and are expected to persist into the second half of 2025, especially with regards to copper.

As always, we appreciate your support and comments.

Leave a Reply