What Stanley Black Decker Earnings Tell Us About Channel Demand

The latest Stanley Black Decker earnings tell a split story. Margins are improving, but the volume underneath is soft, and the gains are coming from pricing and cost structure rather than demand. For distributors and contractors who sell, stock, and rely on DeWalt, Craftsman, and Stanley products every day, that distinction matters. It shapes how you plan inventory, how you think about sell-through, and how much confidence you put behind near-term commitments.

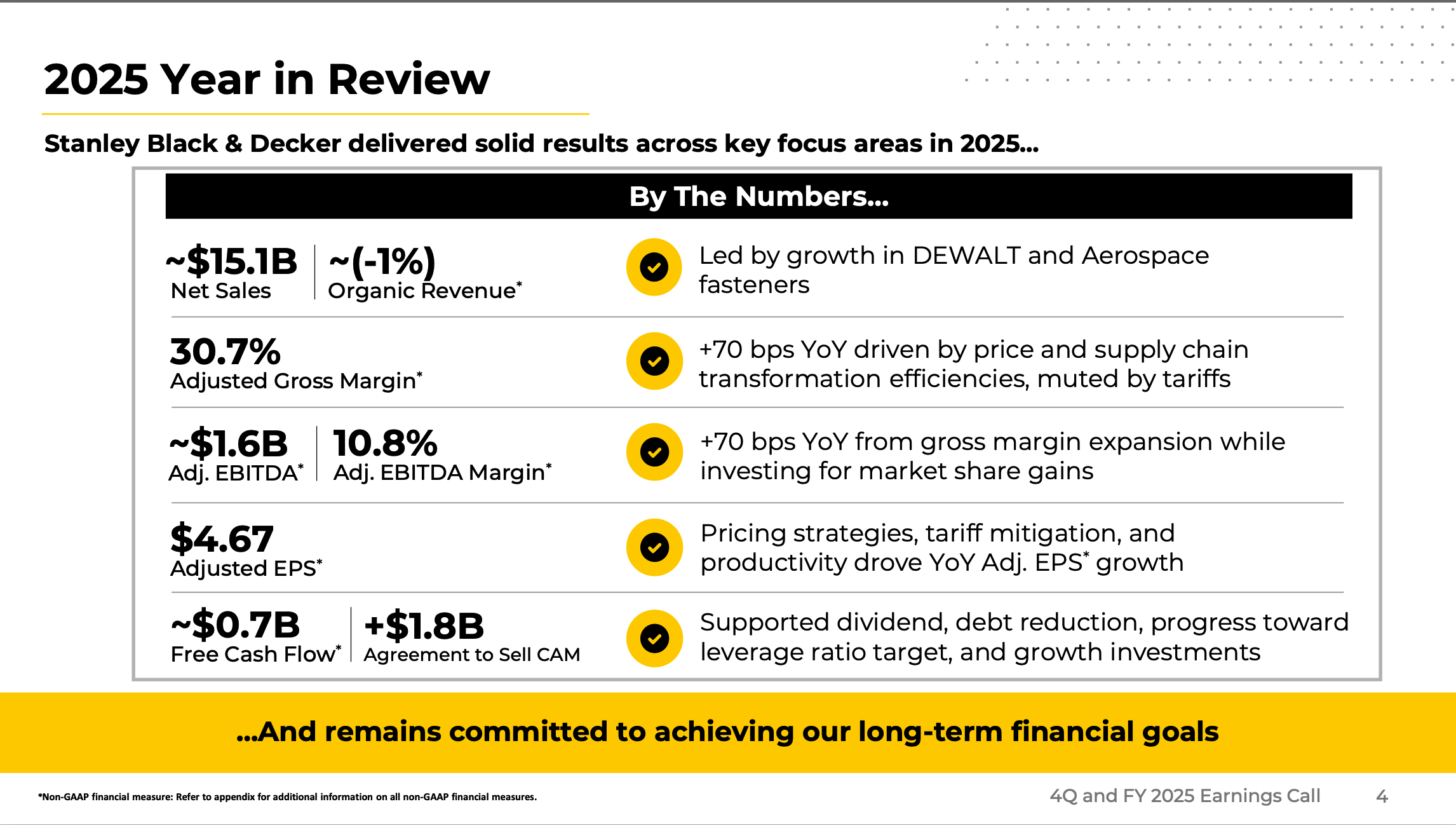

Stanley Black & Decker reported Q4 2025 and full year 2025 results on February 4, and the headline numbers told two very different stories depending on which line you read first.

The Quarter at a Glance

Net sales for Q4 came in at $3.7 billion, down 1% overall and down 3% on an organic basis. Price contributed 4% and currency added 2%, but those gains were more than offset by a 7% decline in volume. Adjusted gross margin hit 33.3%, up 210 basis points year-over-year, driven by higher pricing, tariff mitigation efforts, and supply chain cost reductions.

For the full year, net sales totaled $15.1 billion, down 1% organically. Adjusted gross margin for 2025 was 30.7%, up 70 basis points, supported by price and supply chain transformation efficiencies but partially offset by tariffs.

The margin story looks good on paper. The volume story does not.

Tools and Outdoor: The Core Business Under Pressure

Tools & Outdoor is the business that matters most to the channel. It represents 86% of company revenue and addresses a $100 billion market across residential and nonresidential construction. Within the segment, power tools account for roughly 49% of revenue, hand tools and accessories and storage make up 28%, and outdoor power equipment rounds out the remaining 23%. About 63% of the segment revenue comes from the US.

In Q4, Tools & Outdoor revenue was down 2% to $3.16 billion. Price added 5% and currency contributed 2%, but volume dropped 9%. That is a significant decline, and management attributed it primarily to soft power tool demand in North American retail channels and a weak overall market backdrop.

For distributors carrying DeWalt, Craftsman, or Stanley lines, a 9% volume drop is not abstract. It shows up in slower turns, heavier inventory positions, and fewer pull-through orders from contractors. When the gains are coming from price rather than units moving, the channel feels it differently than when business is genuinely growing.

What Stanley Black Decker Earnings Tell Us About Channel Demand

The fundamental question for distributors and contractors is whether this softness is temporary or structural. Management has pointed to soft North American retail demand, but the numbers suggest more than a seasonal dip. Volume has been under pressure for multiple quarters, and the company has leaned heavily on pricing and cost reduction to hold the P&L together.

Shareholders are asking the same thing. The concern is that margin improvements driven by cost cuts and price increases are not sustainable if the underlying demand is not there. Cost-driven margin expansion has a ceiling. At some point, you need volume growth to keep the story moving forward.

For contractors, this means tool pricing is likely to hold or increase, even as demand softens. For distributors, it raises questions about how aggressively to stock ahead and whether promotional activity from SBD or competitors will shift in the coming quarters.

Engineered Fastening: A Bright Spot With Limited Channel Overlap

The Engineered Fastening segment posted 8% organic revenue growth in Q4, reaching $524 million. Volume was up 7%, driven by a 35% increase in aerospace and strong demand in the automotive market. This segment addresses a $25 billion market in general industrial, automotive, and aerospace applications.

While this is a positive signal for the industrial side of the business, it has limited direct relevance for most HVACR distributors and contractors. The takeaway is more about what it says about SBD as a company. The diversified portfolio is helping offset the weakness in tools, but it does not fix the core demand problem in the segment that touches the channel most directly.

The CAM Divestiture and What It Signals

Stanley Black & Decker sold its Consolidated Aerospace Manufacturing division to Howmet Aerospace for $1.8 billion in an all-cash transaction. CAM was a specialized aerospace components business generating about $410 million in revenue, focused on mission-critical hardware for commercial and defense applications.

The sale is about focus and balance sheet health. SBD is using the proceeds to pay down debt, protect its credit rating, maintain the dividend, and fund continued restructuring. The message to the channel is that SBD is doubling down on tools and outdoor as its core identity. That is a bet on the long-term strength of the residential and nonresidential construction markets, even as near-term demand remains uneven.

2026 Guidance: Conservative and Cautious

SBD issued FY2026 EPS guidance in the range of $4.90 to $5.70, which came in below Wall Street expectations. The company did not provide explicit revenue guidance at the total company or segment level. Management commentary pointed to ongoing demand softness in Tools & Outdoor and continued portfolio simplification.

The lack of revenue guidance is notable. It suggests management does not yet have clear visibility into when volume will recover, and the wide EPS range reflects meaningful uncertainty about the macro environment and its own demand trajectory.

For channel partners, this is a signal to plan conservatively. SBD is not projecting a strong demand rebound in 2026, and distributors should calibrate inventory and staffing plans accordingly. Contractors should expect stable-to-rising tool prices with no meaningful relief from promotional activity in the near term.

The Channel Takeaway

Stanley Black & Decker is doing the right things operationally. Margins are improving, the portfolio is getting more focused, and the balance sheet is being strengthened. But none of that changes the fact that demand in the core tools business is soft, and the gains are coming from price and cost management rather than genuine growth.

Distributors should watch sell-through data closely over the next two quarters. If volume does not start to recover, the pricing gains that have been supporting margins will come under increasing pressure from both the market and from competitors looking to buy share. Contractors should be aware that tool costs are unlikely to come down and should factor that into project bids and equipment budgets.

The numbers say SBD is a well-managed company navigating a difficult demand environment. The question for the channel is how long that environment lasts.

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

About the Author

Kevin Coleman covers quarterly earnings and financial performance for HVACR Trends, with a focus on what the numbers mean for manufacturers, distributors, and rep firms operating across the channel.

Leave a Reply