MSC Industrial launched their third-quarter earnings report in July and the industrial waters have ben choppy this year, but the size of the overall North American market creates opportunities for growth.

MSC Industrial – a distributor of a broad range of metalworking and MRO products and services, reported third quarter financial results on July 1, showing a 0.8% year-over-year decline in sales for the March-May period, but sequential growth of 8.2% from the second quarter.

While MSC Industrial’s results met Wall Street’s expectations, there are signs of pressure, especially on margin as profitability metrics weakened. Most troubling is the 22.5% decrease in operating income to $82.7 million, with operating margin contracting from 10.9% to 8.5%. Adjusted operating margin fell to 9.0% from 11.4%, a 240 basis point deterioration. Does this suggest structural challenges or temporary headwinds. Year-to-date numbers show a 2.7% revenue decline

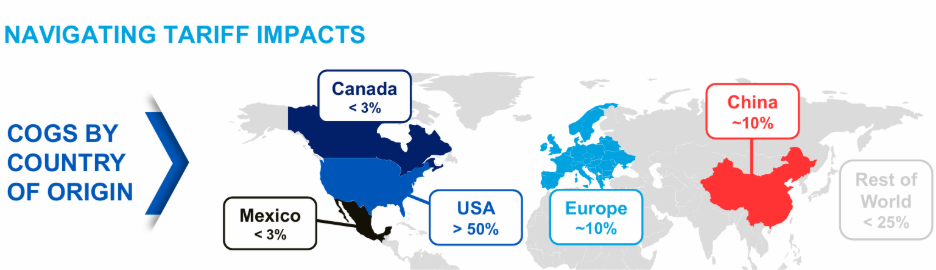

CEO Erik Gershwind highlighted that web enhancements and targeted marketing helped boost direct traffic and conversion rates, while new In-Plant and vending installations supported customer retention. These strategic initiatives as starting to yield results. Management also addressed ongoing macro softness in key manufacturing sectors like automotive and metals, noting that aerospace remained a relative bright spot, as was “Made in USA” product offerings, commenting that the macro situation has stabilized during the quarter. The CFO, Kristin Actis-Grande stated that growth in US-made product sales was tied more to cost-saving programs, rather than preemptive buying ahead of tariffs. MSC’s exposure to tariffs was highlighted in the earnings presentation:

**Note – the EU tariff has recently been renegotiated to 15%

What will be the impact of further price adjustments and tariff-related supplier negotiations on gross margins?

How will MSC’s strategy progress in digital platform engagement? What will be the bottom-line impact of cost-saving and productivity programs? Additionally, there are risks, specifically subdued manufacturing end markets that could impact sales; tariff uncertainties which may affect customer purchasing decisions and potential volatility in raw material prices, especially copper (which has some major tariffs applied).

Tariff uncertainties complicate customer purchasing decisions, and it will be interesting to see how MSC manages the tariff and market issues in Q4.

As always, we appreciate your support and consideration.

Leave a Reply