This past week plus three publicly traded Industrial Supply Association Members shared quarterly earnings, and we wanted to share the quick highlights on the releases from Grainger, Stanley Black and Decker and WESCO.

Grainger Q1 2025 Earnings

Grainger announced 1Q25 earnings on May 1, 2025 of sales of $4.3 billion, up 1.7%, or 4.4% on a daily, constant currency basis, driven by strong online demand and diluted EPS of $9.86, up 2.5% compared to the prior year quarter. This exceeded estimates of $9.46 per share, however the revenue estimates fell a bit short of expectations.

In the High-Touch Solutions – N.A. segment, sales were down (0.2)%, or up 1.9% on a daily, constant currency basis, year-over-year driven by growth across all geographies. In the Endless Assortment segment, sales were up 10.3%, or 15.3% on a daily, constant currency basis, year-over-year, driven by strong performance at both MonotaRO and Zoro.

Editors Note: The below is an excerpt from our February Analysis on Grainger’s year end performance that provides detail on how Grainger classifies their business segments.

“If you follow Grainger closely you will see that they have been classifying their business into two segments

- High-Touch Solutions

- Endless Assortment

Basically, to make is simple I think of it this way – High Touch Solutions are the historical branch and DC based Grainger business that is a combination of digital backed with experienced associate support. Endless Assortment are the digital solutions provided by Zoro and MonotaRO.” John Gunderson Industrial Supply Trends February 5, 2025

Opinion: Grainger Q4 and Year End Results…..Interesting – Industrial Supply Trends . Link to the full February segment analysis from Industrial Supply Trends.

In the Q1 release Grainger reaffirmed its 2025 cautious guidance from earlier in the year, which incorporates known impacts of tariffs today and assumes that mitigating actions help offset future potential impacts.

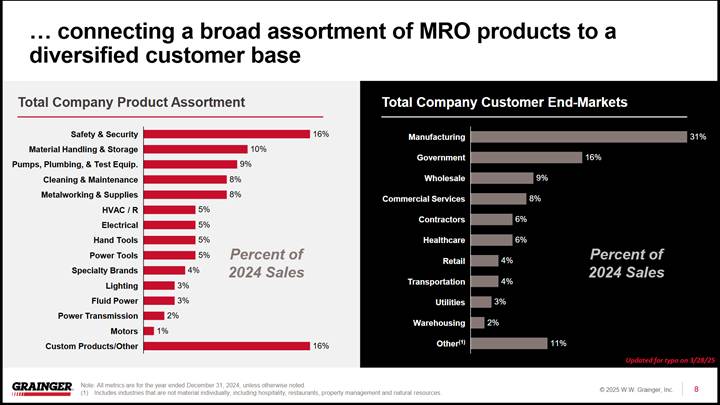

The following shows the breakdown of Grainger’s sales by product category and customer performance

Source: Grainger Q1 2025 May 1, 2025 release

Stanley Black and Decker

Stanley Black & Decker, the New Britain, CT-based tool manufacturer, posted 1Q25 earnings on April 30 with revenue of $3.7 billion, down 3% year-over-year, with 1% organic growth offset by currency and the Infrastructure division divestiture. Gross margin increased 130 basis points and adjusted gross margin increased 140 basis points to 30.4%.

Selling, General and Administrative expenses (SG&A) increased to 23.2% of sales, driven by investments in revenue generating initiatives designed to deliver increased market penetration and future market share gains. Despite that,1Q25 EBITDA as a percent of sales was 8.9% versus 7.1% in the prior year, and adjusted EBITDA was 9.7% of sales versus 8.9% of sales in the prior year.

Specific responses to tariffs include price increases in April and during 3Q, supply chain adjustments leveraging Mexico to reduce China tariff costs over the next 2 years and ultimately, leverage its North American footprint as a competitive advantage (~60% of U.S. cost of sales). SWK did quantify the tariff impact on EPS at roughly -$0.75 per share reflecting timing to implement mitigating countermeasures. As Executive VP and CFO Patrick D. Hallinan stated “Our top priorities remain generating cash and restoring balance sheet strength, margin expansion, and to position the Company for long term growth and value creation.”

WESCO Q1 Release

Editors Note: WESCO is an ISA member who is the largest electrical, datacom, and utility distributor in North America with a large Industrial Business. Their releases do not break out their total industrial business in detail for Industrial only analysis.

WESCO, on the other hand, had a mixed quarter exceeding revenue estimates but missing earnings per share. Overall sales were flat at $5.3 billion, with organic sales up 6% driven by 70% growth in data center sales and high single digit growth in the Broadband and OEM businesses but offset by the Integrated Supply divestiture and foreign exchange headwinds impacts.

WESCO reaffirmed full year 2025 outlook based on positive momentum from the first 4 months of the year. Backlog increased in all three WESCO business units. WESCO increased inventory to help manage potential supply chain impacts of global tariffs and will focus on other activities under Wesco’s control in the uncertain and volatile environment including cross-selling, an enterprise-wide margin improvement program, and operational improvements resulting from business transformation initiatives.

Gross margins declined, leading to a decrease in Adjusted EBITDA. This primarily reflected a $6.9 million increase in SG&A expenses driven by higher facilities and transportation costs that were partially offset by lower payroll expense, a $6.3 million decrease in net sales, and a $6.0 million increase in cost of goods sold related to increased large project sales to customers.

Kevin’s Key Takeaways

Tariffs and the potential impact are the hotly reported on items this year for all public companies, and we certainly expect that to continue as further earnings are released. I found Stanley Black and Deckers comments on leveraging their North American Footprint as a competitive advantage enlightening.

Overall Market conditions continue to evolve and we will continue to track and report on the data over the next months. I’ve included a link to our recent economic snapshot for the industrial channel below for reference

Industrial Supply Trends Economic Snapshot – Q1 2025 – Industrial Supply Trends

If you have thoughts or comments on any of the three companies earnings to share, please feel free to reach out to our team.

Leave a Reply