Fastenal Investor Day Slide – March 13, 2025

One of the biggest stories I have been writing about this past year has been on Business transformation, and on the very large end of the distribution demographic landscape, perhaps no company exemplifies long-term, wholesale change than Fastenal.

Yesterday on March 13th Fastenal held a close to 6-hour Investor Day presentation that shared a ton of compelling data and information. They have been very open sharing their goals and strategy in the industrial channel, and I think channel leaders can learn much from the Fastenal story.

P.S. I will be writing a number of stories about the Fastenal Investor Day presentation over the next few weeks to share with Industrial Supply Trends readers.

Some of tidbits that were shared on Investor Day that jumped off the page were the following:

2013: U.S. Branches Peak at 2,408

Current: U.S. Branches are at 1,264

Still serve the core function of placing people

and inventory close to our customers

Within a 30-minute drive of 93.5% of U.S.

industrial manufacturing base

*Investor Day Presentation

I love that “placing people and inventory close to our customers” quote. Its Distribution 101 you might say, but Fastenal has accomplished above market growth and almost doubled sales in a decade (organically with limited acquisitions) while reducing their branch locations by almost half. They have more than evolved their business from being the distributor with locations in every good-sized city in America to a distributor that has changed their distribution model dramatically.

Over the past year, Modern Distribution Management (MDM) published a three-part article series and extensive special report that I wrote on Fastenal about what I called Fastenal’s “Big Pivot”, which referred to the distributor’s decade-long transformation from a company largely reliant on a nationwide network of branch locations — still the business model for many top distributors — to a company driven by embedding inventory and supply chain solutions within customer facilities. They have many other key strategy and tactical moves which we wrote about extensively (the links to the series are below.

You can see the full MDM Fastenal series here: Part 1, Part 2, Part 3 and we did a podcast that dove deep into the big moves Fastenal has made over the past decade to transform their business.

Every distributor is going through or has gone through business transformation over the past decade — and that accelerated after COVID. While much of the industry has focused on scaling their eCommerce solutions, Fastenal has been focused on giving their customers tools to better manage their inventory to become more important and strengthen relationships with their core customers.

Our “Pivot” series viewed Fastenal’s through a detective lens and as a case study, examining what happened over the past decade that led to the company’s strong growth and performance that has made them one of the Distribution Darlings of Wall Street.

MDM Podcast: A Breakdown of Fastenal’s Decade-Long “Big Pivot” – Modern Distribution Management

If you would like to listen to our overview on Fastenal versus reading the series the link to the companion MDM podcast is above.

“I just think it’s a fascinating story,” Gunderson told MDM’s Tom Gale in the podcast. “Their financial performance is exemplary, and the way Fastenal has done it is kind of revolutionary in a lot of ways.”

Fastenal has nearly doubled its total sales over the past 10 years, and while its gross margin has declined overall in that time, the company has grown its total EBITDA and net profits significantly, despite closing about 1,000 branches and without relying on acquisitive growth.

“They did it organically, and it’s almost unthinkable,” I emphasized on the podcast. “And when you dive into it, they moved from a branch-based distributor to what I call a customer-focused distributor.”

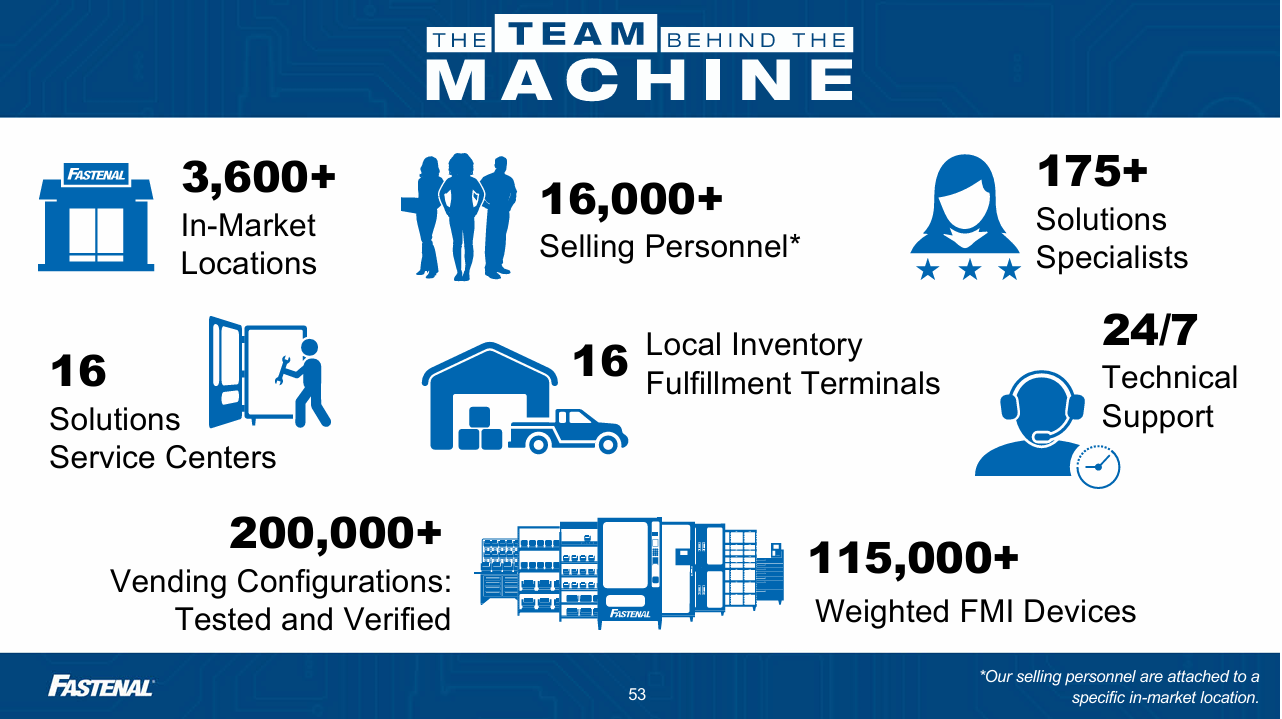

In the MDM series and podcast we dove deep into how automation has been key to Fastenal’s decade of transformation — both in terms of its tech stack processes to embedding vending solutions or Fastenal employees on the plant floor of manufacturers.

“Once they put the human assets at the physical location, they also backed it up with an incredible tech stack,” I added, and we talked about Fastenal’s forward-looking statements that share that the company expects to get 66% of their total sales volume through digital channels.

Achieving two-thirds of your business volume via digital takes considerable costs out of the selling equation, while also creating a great customer experience.

If you have thoughts or comments on Fastenal to share, please feel free to reach out. There is much to learn as an Industrial Distribution Channel leader from the Fastenal story that may apply to your unique distribution business.

Leave a Reply