At Industrial Supply Trends, we pay attention to the earnings and announcements from ISA members. Stanley Black and Decker announced their Q2 Earnings and shared insight on Tariff impacts, and the Stanley Black and Decker strategy to navigate those tariffs.

Stanley Black and Decker is a partner for many ISA members and a key supporter of ISA. At this years, ISA Fall Summit Steve Hudson Vice President of Digital Services, Stanley Black & Decker will be speaking at the event. Our Channel Marketing Group team is looking forward to Steve’s presentation and all the great Fall Summit presentations from the who’s who of Industrial Distribution in the three tracks at the ISA Summit in Memphis.

Stanley Black and Decker – the Connecticut-based manufacturer of tools, including brands like Dewalt, Craftsman, Stanley, Cub Cadet, Troy Build and Black and Decker, as well as industrial solutions and fasteners, announced Q2 2025 earnings on July 29. Revenues came in at $3.9 Billion, down 2% year-over-year and below expectations, driven by a slow outdoor buying season and tariff-related shipment disruptions. Organic revenue was down -3%.

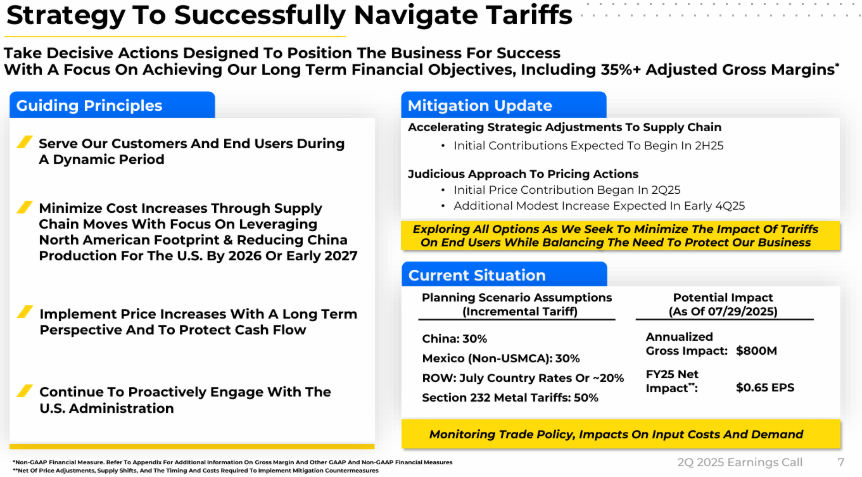

Supply chain issues—primarily related to tariffs and shifting global production—significantly affected Stanley Black & Decker’s 2Q25 performance. The 2% year-over-year revenue decline, and margins under pressure were impacted by tariffs and contributed to a decline in the adjusted margin rate for the Tools & Outdoor segment to 8.0%, down from the prior year. In fact, tariffs produced an annualized gross impact of approximately $800 million. This combination of higher input costs from tariffs and lower shipment volumes led to gross margin compression, despite price increases meant to pass on some of the costs to customers, including more price hikes in early Q4 2025.

Operationally, the professional DEWALT brand was a bright spot. Stanley Black & Decker is continuing its supply chain transformation and global cost reduction program, aiming for $2 billion in pre-tax run-rate cost savings by the end of 2025, with $150 million achieved in 2Q25.

The company accelerated supply chain adjustments—such as reallocating sourcing toward North America and Mexico—to reduce reliance on China, with over 60% of cost of sales now based in North America. This transformation program has delivered $1.8 billion in pre-tax run-rate cost savings to date.

Some key questions include:

- Will tariff mitigation efforts protect margins and earnings?

- Can the company deliver on its supply chain and cost transformation objectives?

- How will end-market demand, especially for Tools & Outdoor, evolve?

- The continued impact and management of tariff volatility on supply chain costs.

- Whether additional price increases in early Q4 2025 will affect demand elasticity or market share.

- The fine line balance between cost reductions and necessary investments in innovation, brands, and growth.

As always. we appreciate your comments and support.

Leave a Reply