As we enter the final stretch of 2025, I am having daily conversations with many distributors and manufacturers about their in-stock inventory positions.

Industrial and Construction Channel growth rates have slowed fand now are slightly down to at best flat in 2025. Inflation and price increases have continued to climb since early 2023. So, that slow/no market combined with rising prices = reduced unit sales for your business.

Your ERP (Infor, Eclipse, P21, NetSuite, SAP etc.) is built to manage your system inventory reorder points based on stable demand, but with slower unit sales the excess inventory for many distributors and the manufacturers that serve them has grown.

Those are some formidable inventory challenges and headwinds for your business if you don’t take some unique approaches to address them.

1. Your ERP sets reorder points primarily on historical sales data, and when demand slows – Inventory levels build

As the Industrial and Construction business has slowed proper inventory levels are more volatile, and chances are you will build or have built excess inventory.

For example: You also may have had in 2025 a SKU from a manufacturer that was an “B” SKU, but it now shows up in your system as a “C” SKU. The product depth for each SKU now off, and it is likely that your philosophy of the depth of each of your SKUs A-D you stock is creating system-suggested reorder points that are off.

Analyzing your SKU movement data is critical to uncover the SKUs that need an experienced team member to dive further into the data. This first one will help, but it will not be enough to uncover the full picture without additional data overlays.

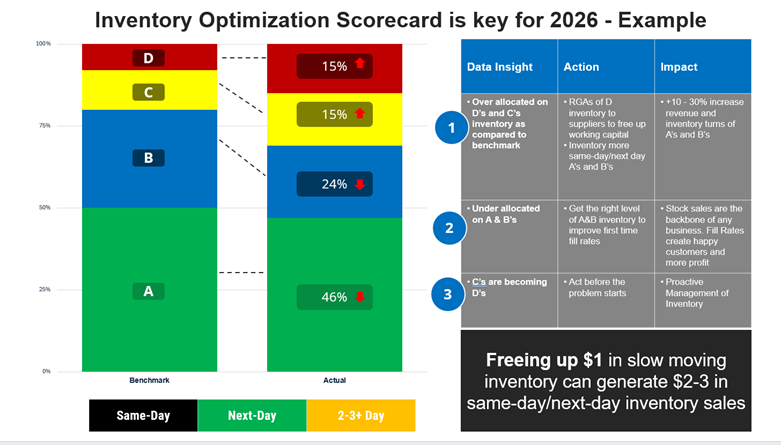

Example: A Distributor that has become unbalanced and building more slow moving inventory than desired.

2. Overlaying your customer sales data on top of your inventory analysis is critical.

This is as crucial a step as overlaying your top customers’ sales data at the SKU level will highlight additional SKU movement. For example: maybe historically one of your top and most loyal customers that prefers a particular brand for an “A” SKU. You may have during the supply chain issues that you were not able to get that brand or had to substitute to another brand because of an availability issue — or another supplier had it in stock at a cost that was significantly lower, as they had bought it in large lower-priced quantities before prices went up.

So, your customer went to another supplier to fill the order. This caused that former “A” SKU to move to “C.” What happens when the customer comes back for another order and needs 50 of them, and you only have 25 on hand because your system only said to have 25 of that “C” SKU on-hand?

The customer again goes down the street and orders that SKU from the competition. Without deep dive on SKUs that have moved in importance (“A” through “D”) with your top customers, you might just get caught in a “we-don’t-have-it inventory hamster wheel” that hurts top-line sales and customer relationships.

3. Get out of your own Inventory Echo Chamber-

Often in my distribution career we were so focused on what we were doing and our processes that we occasionally “group thought” ourselves into trouble. There are other ideas and paths to consider, but we did not take the time to expose ourselves to them.

Participating in programs and education from a proven Inventory leader like Blue Ridge Global and others will help your team learn about best practices and other ideas and paths to consider. I am attending and speaking at a Blue Print where top inventory leaders are gathering early next year in Atlanta.

The registration link for this great event and I hope you consider it.

I would recommend you consider programs like this and others to help your team see best practices and programs for consideration. It is an effective way to get out of your own group think processes and learn from others.

Key Takeaways

Now is the time to make sound inventory and purchasing adjustments by looking at SKU movement and overlaying your top customers’ past and current purchasing data.

The market dynamics with slower growth may be wreaking havoc on your inventory planning and metrics, and your team needs to bring a bit of experienced art to the science of the numbers.

Effective inventory management today is a data project that requires your experienced personnel to make the right manual adjustments to craft an effective inventory plan.

As always, we appreciate your comments so feel free to reach out to us with any questions.

Leave a Reply