Analysis on the recent earnings releases from ISA Members Kennametal and Distribution Solutions Group (ISA member Lawson Products is part of Distribution Solutions Group).

Kevin Coleman – Channel Marketing Group Trends Analyst tracks the leading Industrial Manufacturers and Distributors in the space for Industrial Supply Trends and had an overview below on two ISA members on their recent releases.

Kennametal

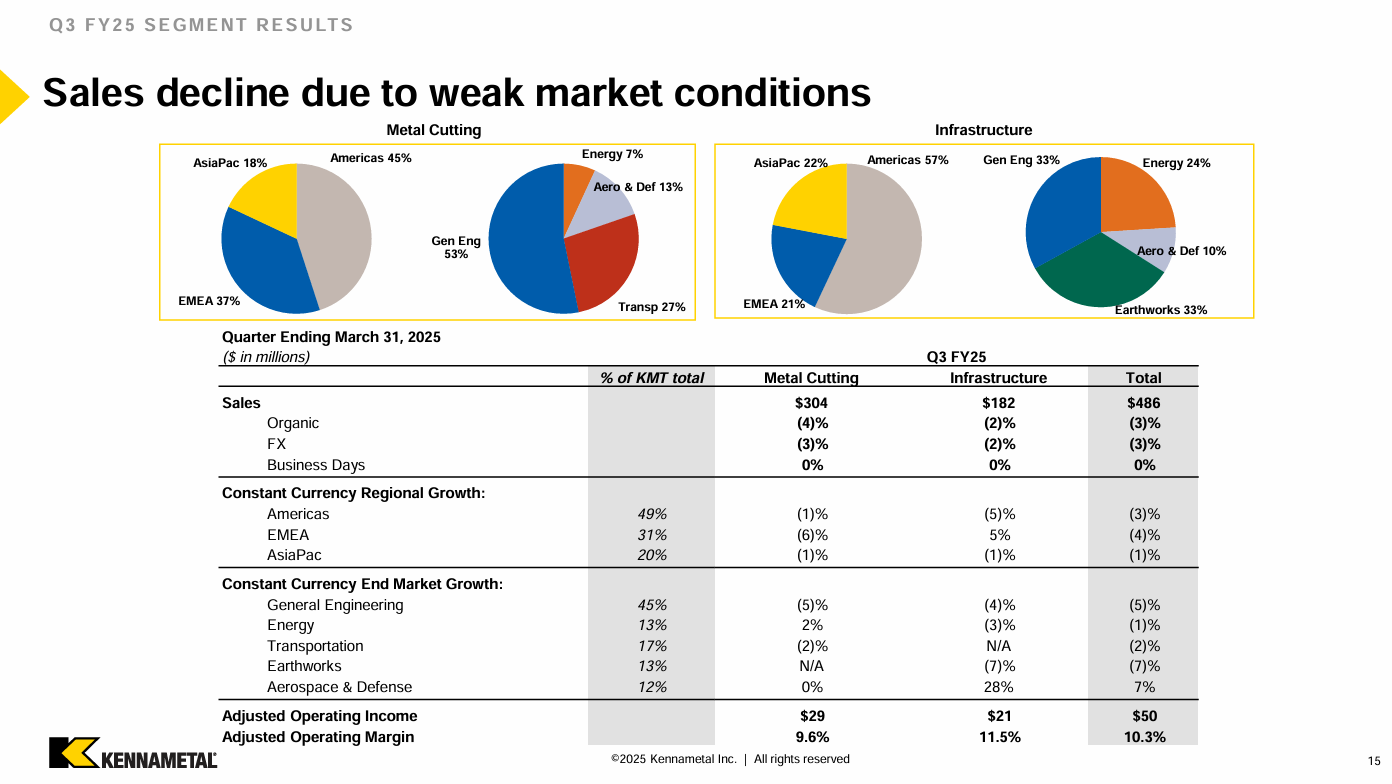

ISA member Kennametal operates with two segments – Metal Cutting and Infrastructure. The Americas region accounts for almost half of sales. After slashing its 2025 outlook in February, Kennametal continues to face challenging market headwinds and slow growth in transportation, engineering, earthworks and energy end markets.

3Q25 sales of $486 million decreased 6% y-o-y, reflecting an organic sales decline of 3% and an unfavorable currency exchange effect of 3%

Sanjay Chowbey, President and CEO cited weakness in EMEA and Americas markets. However, sales and EPS did beat the estimates, especially in EPS where adjusted EPS was $0.47, compared to $0.30 last quarter.

By segment, Kennametal’s Metal Cutting segment saw sales decline 7% YoY to $304.3 million, while Infrastructure sales fell 4% to $182.1 million.

The company cited organic sales declines and unfavorable currency effects. Operating income was $44 million, or 9.1% margin, compared to $35 million, or 6.8% margin, y-o-y. The increase in operating income was primarily due to an advanced manufacturing production credit under the Inflation Reduction Act of approximately $10 million within the Infrastructure segment, lower raw material costs, pricing, and incremental year-over-year restructuring savings of approximately $6 million.

These factors were partially offset by lower sales and production volumes, higher wages and general inflation and an unfavorable currency exchange effect of approximately $3 million.

Kennametal estimated its tariff exposure at around $80 million and has embarked on a number of actions to mitigate, including utilizing its global footprint to optimize product flow, re-routing internal supply chain flows, re-balancing production capacity, implementing tariff surcharges and leveraging their US footprint to capture market share. Kennametal raised its full year 2025 EPS outlook to $1.30 to $1.45 and narrowed its revenue estimates $1.97-$1.99 billion, reflecting continued negative sales volume growth of -5% to -4%, partially offset by a ~2% from prices.

A financial snapshot of Kennametals’ sales by segment, geography and market from the earnings presentation is shown below:

Source: Kennametal May 7, 2025 – Q3 FY 2025 Earnings Presentation

Distributions Solutions Group (DSG) –

This group is composed of 3 business units – Lawson Products, Gexpro Services, and Test Equity.

DSG announced 1Q25 results on May 1, showing a 14.9% growth in revenue, to $478 million.

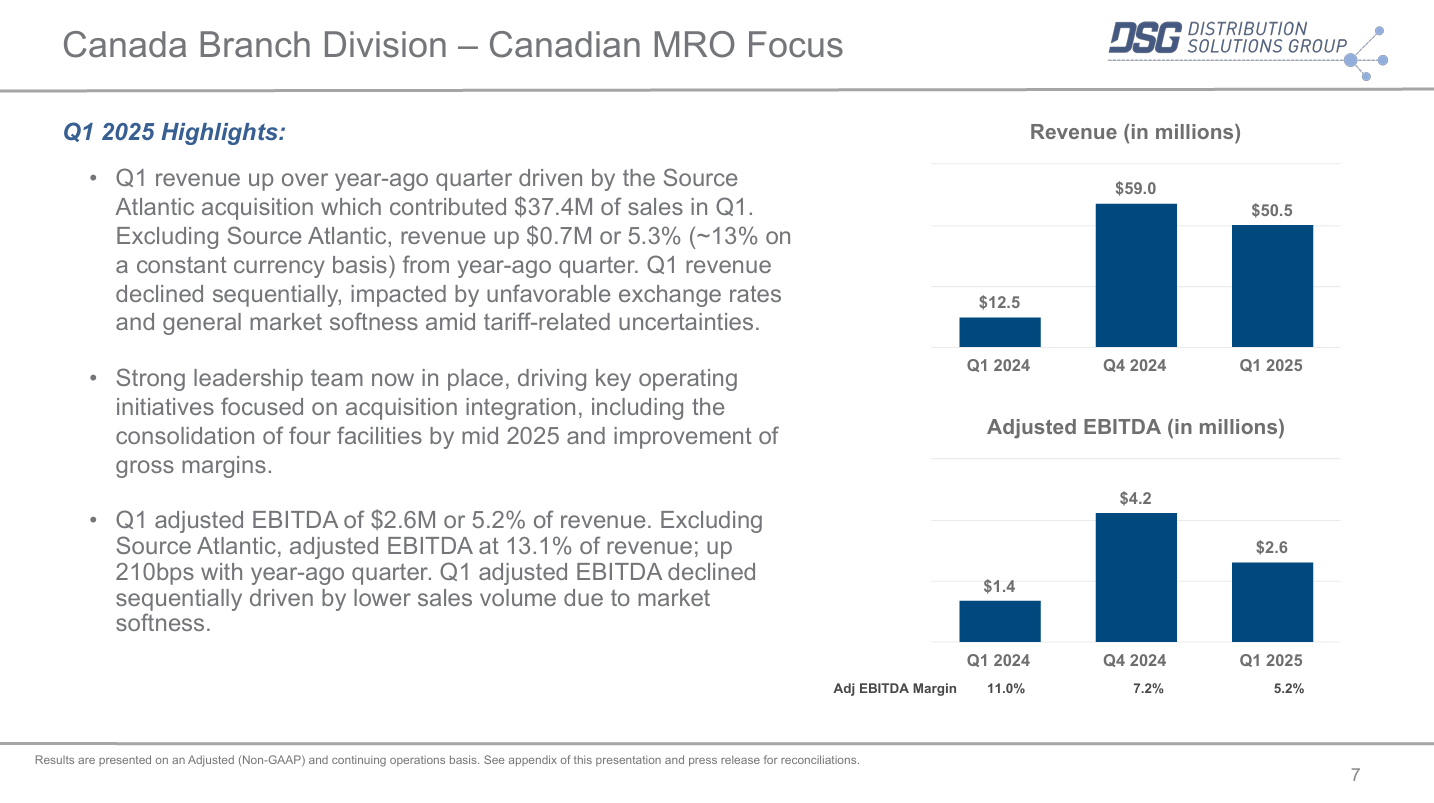

Their organic average daily sales grew 4.3% year-over-year but decreased 1.4% sequentially over 4Q24. Diluted net income per share was $0.07 for the quarter compared to diluted net loss per share of $0.11 in the year-ago quarter. Adjusted EBITDA grew to $42.8 million, or 9.0% of sales, compared to $36.1 million, or 8.7% of sales in the prior year quarter. Margins were negatively impacted by the Source Atlantic, the Canadian MRO business’ results.

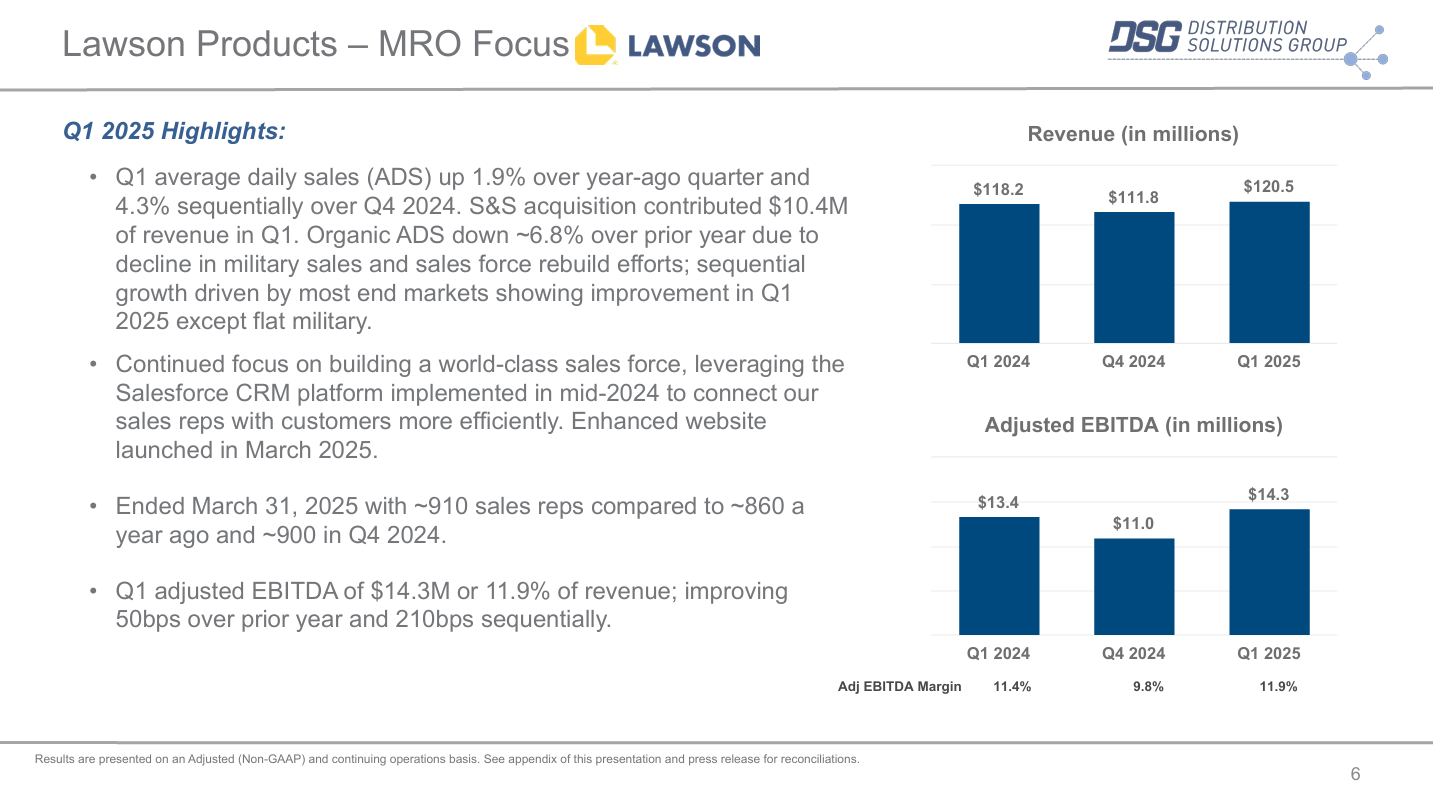

By reporting unit, Lawson Products had sales of $120.5 million, up 1.9% y-o-y. Please note: in the United States Lawson Products is the key brand and in Canada the business unit is comprised of the former Bolt Supply (primarily Western Canada) and Source Atlantic Limited (primarily Eastern Canada). Source Atlantic was acquired in 2024.

Some notable achievements that DSG called out for Lawson Products are comments on CRM progress, an enhanced website, and an increase of 50 sales reps (compared to 2024).

Source: Distribution Solutions Group – May 1, 2025 – Q1 Earnings Release

DSG has in the past few years acquired HISCO-Test Equity, Source Atlantic in 2024, and more. They continue to add complementary acquisitions to their business, and are an Industrial Leader to watch.

As always, we appreciate your comments and questions.

Leave a Reply