Earlier this month, I had a chance to sit down with David Ruggles from Martin Industrial Supply to discuss a wide range of topics. Where the Channel is headed today, how does Martin Industrial grow the in the short term and long term?

As a private company that was willing to share some information, I appreciated the chance to have an on and off-the-record conversation on the Channel, Buying Groups, short-term and long-term trends, and much more.

As part of our ISA member series of profiles in Industrial Supply Trends it is fun to share their story and approach. What we hope to share is how each company is facing the challenges and opportunities in the Industrial Supply Channel in their own unique way. Our goal is that you may be able to gather some insight that you can use for your business from our profile series.

Let’s start with a little history on Martin Industrial

Martin Industrial has an Alabama heritage, and was founded by Louis Martin in 1934. If you are from Alabama, you will know that they take college football rather seriously, so I thought it was important to share that Alabama Football in 1934 went 10-0 and won the Rose Bowl for Alabama’s 4th national championship. I think it is bad form to write about an Alabama company without some Roll Tide or War Eagle content.

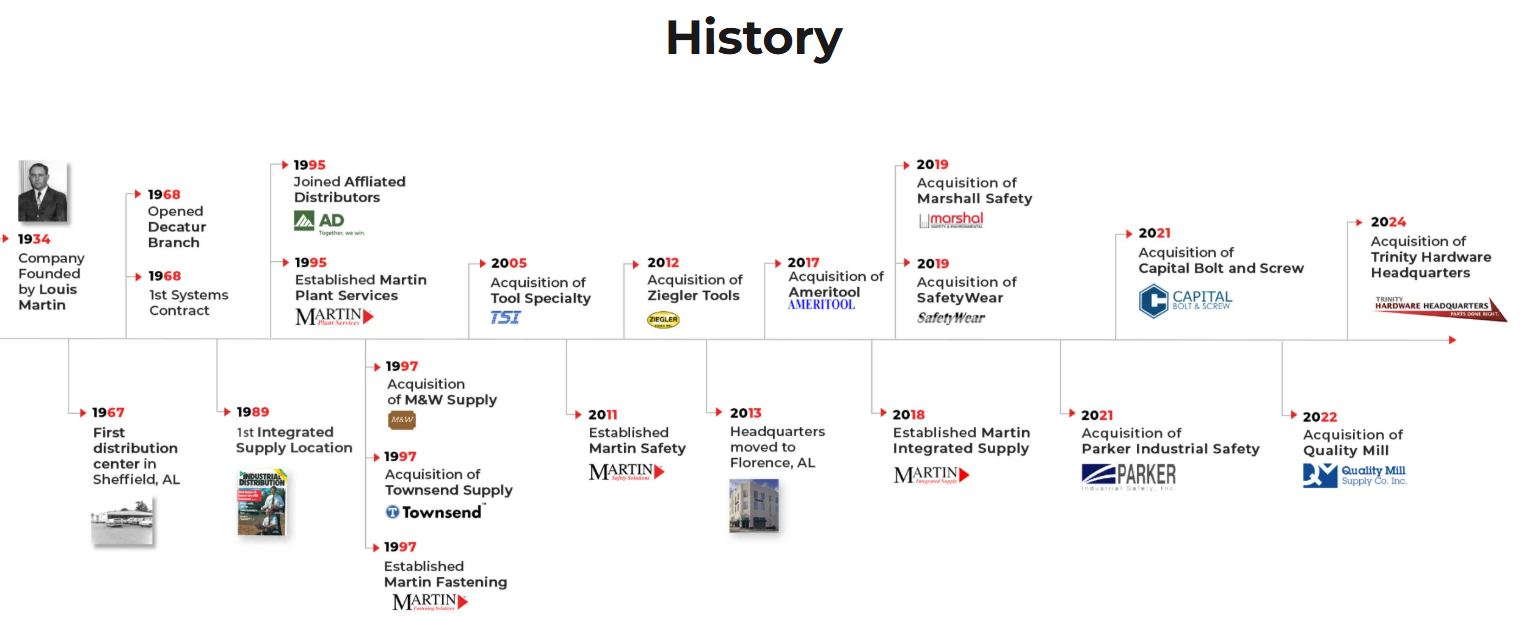

I like that Martin has a great graphic on their history to make sharing their history easy. I thought this graphic has important dates in their history clearly spelled out for review.

The timeline shows that in 1989 – 1st Integrated Supply Location was founded. In 1995, they joined Affiliated Distributors and created Martin Plant Services From 1997 through 2024, Martin grew with 12 acquisitions and also added key Safety and Fastening Divisions.

We asked Co-CEO David Ruggles to answer a few questions for us, and he gave us some great answers. So, I just edited them below and added some of my commentary in Italics, as the Martin answers were compelling.

Q. Describe your company, the markets you serve, and how you differentiate yourself versus your competition.

Martin Supply was founded in 1934 by Louis Martin, and is a privately held, 4th generation Industrial distributor with headquarters located in Florence Alabama. Martin currently has 450 team members in 30 locations, and currently do business in 45 states including Mexico and Canada. Martin has been named one of the top 50 industrial distributors by ID Magazine for the last several years. Martin is an active member of ISA, AD, NAW, NFDA & supplyForce.

Martin’s primary product groups are Safety products and services, Metal Working Products, OEM Fasteners, and Integrated supplies and services. We primary serve the heavy industrial and construction marketplace and have customers of all sizes ranging from fortune 100 manufacturers to small machine shops.

Martin’s mission statement is “We Companies Operate Better” and every team member at Martin is empowered to deliver on that promise to our customers. We deliver on that promise by working with our customers on productivity improvements, documented cost savings and providing services that enable them to make their product safer and more cost effective. Technical Service and Support is big part of the Martin Value proposition.

Q. What would your customers say are the key things that differentiate you?

Our primary differentiator is based on our Core value “Entrepreneurial Spirit” , all our customers are unique, and our team members are empowered to partner with our customers to create a solution based on their specific needs. As a 4th generation independent that hire good people let them serve the customer ethos is cleared spelled out as Entrepreneurial Spirit.

Q. What industry-wide opportunities and challenges do you see, and how should distributors address them?

One of the biggest challenges that we face in our industry is in attracting and retaining talent. It’s imperative that we are purposeful about recruiting, training and identifying our next generation of leaders. We are in a very competitive environment for talent and everyone in the organization needs to be recruiting all the time, most of our new hires come from referrals from current team members. Lastly, we must create a career path for our up and comers and continue to invest time and resources in their growth and development. The issue of attracting and retaining talent is clearly spelled out as a key challenge.

Q. How have your manufacturer/distributor relationships changed over the past five years? What’s the key for the future?

The biggest change in the manufacturer/distributor relationships over the last number of years is the loss of partnership between the 2 parties. Distributors carry too many competing lines and manufacturers have to many distributors in any given market. I think the genie way too far out of the bottle to go back to the time of exclusivity, but I do think both parties would be better off choosing who they will go to market with and partnering with them to build plans around taking market share together. The theme I take away here is the partnership are becoming more transactional in nature. More Short term next quarter thinking vs, Martin being able to focus as a private company on the long term goal of market share gains.

Q. How do you view the changing role of manufacturer and distributor sales representatives? What do you expect from top-performing reps today?

The very top salesman today are true professionals in every sense of the word, they are consultative sellers that use data to make decisions, and they are strategically aligned with their customers and company’s goals in everything they do.

Q. What’s the greatest opportunity and the greatest challenge facing the industry?

In my opinion the greatest opportunity and the greatest challenge for Industrial Distributors is understanding and adopting the latest and greatest in technology, today the biggest potential game changer is AI. Distributors are generally not on the leading edge of technology but will have to be faster to adopt in the future if we want to remain competitive. As more and different types of competitors enter our business we will have to make sure we operate in the most efficient and cost-effective manner and investing resources and time into technology will assure we remain relevant in what most certainly will be a hyper competitive marketplace. Forward thinking about the key foundational element of technology. That distributor foundation is not just great people anymore it must include technology and automation where possible of human non-selling tasks.

Q. What one question would you like every manufacturer to answer for you?

The one question that progressive manufacturers are answering for Martin is how we are going to grow our market share together, that means coming to us with competitive intelligence of who potential customers are in our marketplace and why their products or services will outperform the competition. Again the comments on long term Market Share being the key for Martin is clear.

Q. What’s one thing few people know about your company?

First, I think some people are surprised by the size and geographic reach that Martin has today, I also think many people don’t realize that we have production OEM component parts (Fastener) division and that we import those parts directly from manufacturers in Taiwan and China. I think people are also surprised by the breadth of services Martin offers our customers, such as: OSHA 10- and 30-hour safety certifications, Tool Data Management systems, Gauging design etc. This answer made me smile, as it is all about adding value and responding to customers needs. They source their own OEM parts, and have a deep variety of value added services which create barriers to exit for customers, and barriers to entry for the competition.

Key Takeaways for Industrial Channel Leaders

I have had the pleasure of getting to know their team at ISA events over the past few years and learning more about their company. I was struck by a few key takeaways from the interview and question responses from Martin Industrial and David Ruggles.

- The Martin Focus is on Long-Term Market Share Growth – As you read the responses above – Market Share Growth is again and again a phrase they use. An Integrated Supply Focused distributor like Martin is going to appeal to and attract a distinct employee type. Integrated Supply associates are obsessively focused on serving their customers anywhere, anytime, and with anything. These associates’ personality type is focused on whatever the customer needs…It’s like…You need a picnic table for outside the breakroom….I can find and source that even though it might be the first and last picnic table I ever procure for you. The whole business model is, we will start anywhere on the plant floor, and expand our market share by being your procurement arm. The business model is: I am the easy button for the end customer. Manufacturer partners who want to focus on this quarter versus the long-term will often struggle connecting with Martin Industrial. Martins sales will rise and fall with how that individual plant they serve does, so they have had decades and decades of the sales peaks and valleys. They know in the long run unless the plant closes, it will work out for their business model.

- Martin Industrial needs and relies on the Industrial channel – Martin Industrial like many Integrated Supply distributors is not just procuring product from direct sourcing or manufacturers for their industrial end customers. They are also buying product for their end customers from distributors like Motion Industries, Rockwell Distributors in the electrical channel, from their fellow Affiliated Distributor distribution brethren, and more. The contracts with end users are usually cost-based % contracts so that makes Martin a partner not only to their end customers, but also to distributors who allow them to source products from their business.

If the market conditions change (and they always do) the sales performance for Martin is going to be tied to the performance of the individual plants they serve. That is not a bad business model but it does put you in a position of being more along for the ride and not as in control of your own destiny.

The primary areas of growth control they have that are not tied to the individual plant growth, and the economy are:

- Growing market share at the individual customer level by selling them more SKUs, lines, and product types.

- Growing the number of Integrated Supply customers they serve by writing and winning more annual contracts and proposals.

It is clear to me that Martin Industrial understands – who they are, and how they can and want to grow. They strive to think long-term versus short-term. now bills have to be paid and the lights kept on so you never lose all focus on the short-term, but the more you can focus on how to grow overall market share the better, for every Industrial Channel Business.

P.S. On a fun editor’s note: In my experience most of the Martin Industrial leaders are Alabama Crimson Tide supporters. In spite of that, they allowed a writer who prefers the Auburn Tigers to interview them. That shows wisdom and acceptance, which I appreciate. So, thank you to their team and….War Eagle.

As always, we appreciate the comments and support. jgunderson@channelmkt.com

Leave a Reply