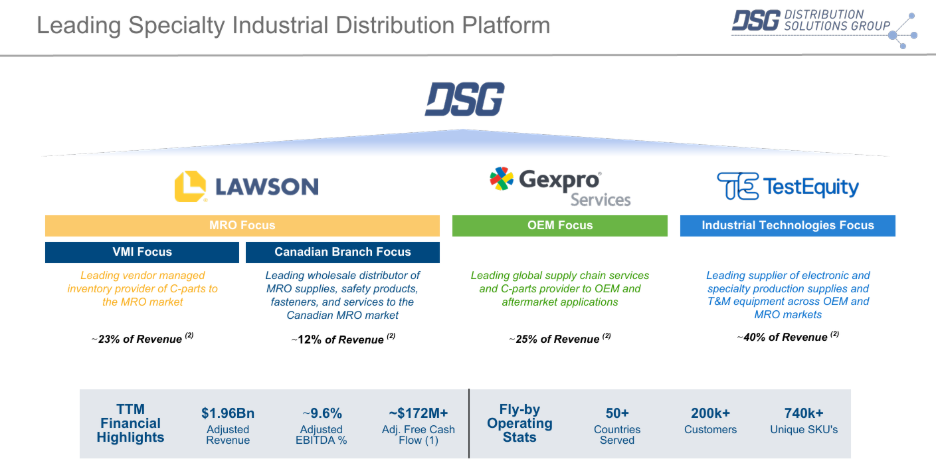

ISA Member – Lawson Products is part of Distribution Solutions Group (DSG), so their results are shown as platform in the overall DSG earnings releases. Lawson showed moderate sales growth in the latest Q2 2025 Earnings Release.

Distribution Solutions Group (DSG) – DSG, the specialty distribution company serving the MRO, OEM and industrial technologies markets, headquartered in Fort Worth, Texas, announced 2Q 2025 earnings results on July 31, showing a 14.3% growth in total sales, to $502.4 million investor.dsg Organic sales grew 3.3% and 2.4% sequentially, over 1Q 2025. It was highlighted that all verticals realized improved margins as a percent of sales sequentially over Q1 2025.

In terms of the macro environment, despite the uncertainty and choppy global macroeconomic backdrop this year, DSG continued to drive momentum in end markets, including aerospace and defense, technology, and renewables with growing demand in the pipeline for industrial power. Production supplies and Test and Measurement continued to be soft.

Gexpro was called out, with “EBITDA margin expansion for Gexpro Services in the second quarter to 13.4%, representing an 80 basis point increase from the first quarter and twice what we enjoyed when we started our transformation of the business when we acquired it in 2020. Expanded value-added capabilities brought to the vertical through strategically identified and pursued acquisitions starting in 2022 are helping drive Gexpro Services EBITDA margins higher than they would have been structurally considered attainable with the capability set in 2020 and are helping bring enhanced credibility with existing and prospective customers around expanding how they think about our value add for them and are leading to wallet share gains and acceleration in new business opportunities.”

Lawson Products Sales Results

Lawson (MRO focus) – Average daily sales (ADS) growth YoY was +2.6% and 1.6% sequentially, featuring broad-based growth across most end markets. Larson continues to invest in the sales force, which is impacting profitability, although they do not expect tariffs to impact margins. They added 90 sales personnel over the last year, and now have about 930 reps. Additional investments are in the CRM platform implemented in mid-2024 to connect sales reps with customers more efficiently and leveraging the enhanced website launched in Q1 2025 to drive expansion of e-commerce channel.

Gexpro Services (OEM focus) – organic revenue grew 18.2% from year-ago quarter on same number of days, while organic average daily sales were up 2.4% sequentially. Gexpro Services saw Improvements in the renewable energy, aerospace & defense and technology end markets and is leveraging DSG cross sell, acquisition synergies and expanded kitting offerings and E-commerce.

TestEquity (Industrial Technologies focus) – Q2 average daily sales were down 1.2% from year-ago quarter on softer electronic production supplies sales and lower T&M sales, but up 1.7% sequentially. Key operating initiatives are focused on continued acquisition integration, pricing discipline, sales force optimization, digital channel expansion and cost containment.

Additional details on the 3 segments of DSG from the earnings presentation:

DSG does not provide formal guidance, but did note that there was nothing unusual in the second quarter that would impact either way and they are cautiously optimistic as they move through the rest of the year.

Some shareholder concerns voiced during the earnings conference call include earnings per share, which fell 48% short of expectations, despite the strong revenue growth. Also, margin compression is a concern. Softness persisted in several segments, notably TestEquity as sales in electronics production and measurement remained weak. There is a concern that much of the growth is acquisition-driven, and organic growth is tepid, highlighting that execution and integration risk may be issues.

As always, we appreciate your support and consideration. Please feel free to reach out to me with any questions.

Leave a Reply