Kennametal launched their fourth-quarter earnings report in August and the industrial waters have been choppy this year, but the size of the overall North American market creates opportunities for growth.

Kennametal – Kennametal, headquartered in Pittsburgh, PA, delivers productivity to customers through materials science, tooling and wear-resistant solutions for the aerospace and defense, earthworks, energy, general engineering and transportation industries. Kennametal operates with two segments – Metal Cutting and Infrastructure. The Americas region accounts for nearly half of sales, with the US market representing nearly all of that – therefore, the US is about half of Kennametal’s sales.

Kennametal reported 4Q 2025 earnings on August 6, facing continued operational and market headwinds, both revenue and profit fell well below the prior year and analyst expectations. quarterly sales declining 5% to $516 million. Adjusted operating margin dropped to 7.4% (from 11.5% a year ago), as lower sales volumes, continued inflation—including wages and raw materials—and tariff headwinds offset cost-cutting benefits. The quarter featured persistent demand weakness across industrial segments, margin and profit pressures from tariffs and inflation, and heavy reliance on restructuring for cost relief.

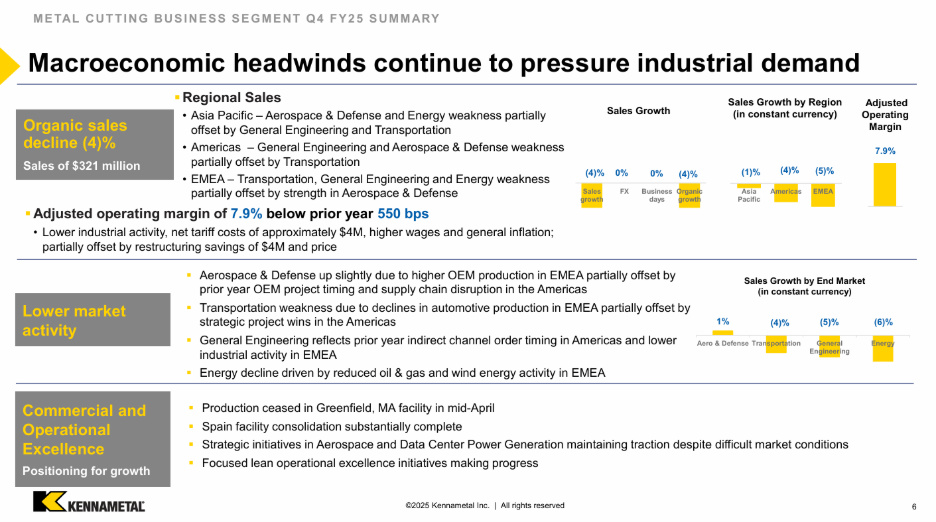

By segment, Metal Cutting sales fell 4% organically, with adjusted operating margin down to 7.9% (from 13.4%), pressured by weak industrial demand and unfavorable pricing/cost mix. Infrastructure sales were down 5% organically to $196million, with a margin of 6.8% (down 190 bps year-over-year) due to reduced mining and earthworks activity, and higher raw material costs.

Details on the performance and drivers for the Metal Cutting Segment, which address the industrial and engineering markets from the earnings presentation, are below:

For fiscal 2026, Kennametal expects revenue in the range of $1.95–$2.05billion, implying ongoing tough industrial conditions, with volume forecast at -5% to flat, with some offset from price/tariff surcharge and foreign exchange tailwinds. While management raised its cost savings target to $125 million by 2027 and continues plant closures and restructurings shareholders expressed concerns about whether these actions can offset the impact of sluggish sales and maintain competitiveness in a difficult environment.

Shareholders were concerned about both top line growth and bottom line profitability and are worried about Kennametal’s ability to sustain profitability in a tough macro environment. The question is if restructuring and plant closings are the only card Kennametal has to play in the short run and if that is enough?

As always, we appreciate your support, comments and consideration. Please feel free to reach out with any questions.

Leave a Reply