It is unusual for a large B2B publicly traded distributor to share details at the level Fastenal has recently provided during their Investor Day, their quarterly results, and annual report. In this column we will cover Fastenal’s recent releases on Sales, Customer Segmentation, and their Focus 40 program.

We follow them closely on Industrial Supply Trends as they are one of the most open publicly traded distributors in terms of sharing strategy and direction. They have made more major pivots in the past decade than just about any leading company in the Industrial Channel.

As our regular readers know… I have authored a long running series of articles and in-depth case study for Modern Distribution Management (MDM) that takes a very deep dive on Fastenal.

MDM Podcast: A Breakdown of Fastenal’s Decade-Long “Big Pivot” – Modern Distribution Management You can see the full MDM Fastenal series here: Part 1, Part 2, Part 3

If you would like to review our Channel Marketing Group analysis and overview on Fastenal the link to a companion MDM podcast and in depth 3 part series is above.

At Industrial Supply Trends our team (David Gordon, Kevin Coleman CMG Analyst, and myself) continue to follow the Fastenal Story closely and have been writing regularly on their story.

FASTENAL SALES SEGMENATION SUCCESS

Casey Miller Fastenal Senior EVP of Sales shared one key quote recently that concisely summed up to me why Fastenal has had above market account growth success. “We do a good job of determining market potential, so we can see market share.”

The Fastenal Sales plan starts from the simple foundation of understanding which end Customers have the potential to become $10,000.00 or more a month customers. Then they focus on those customers with programs (Vending, Onsite, Digital) and sales and support resources to grow them.

It’s a simple 1-2 punch sales program. 1. Identify Top Sales targets by size and value to the business 2. Devote sales resources to call on and service those customers and give them programs to support them (vending, On-site, Digital, etc.)

I used the term “simple 1-2 punch sales program” with irony, as although it may be an easy-to-understand sales approach it is very hard to execute as a distributor.

Fastenal knows that every sales plan starts with understanding the potential and size of every customer they serve and then focuses their sales resources on those top potential customer district by district. Let’s take a deep dive on how I believe Fastenal is executing on this sales plan.

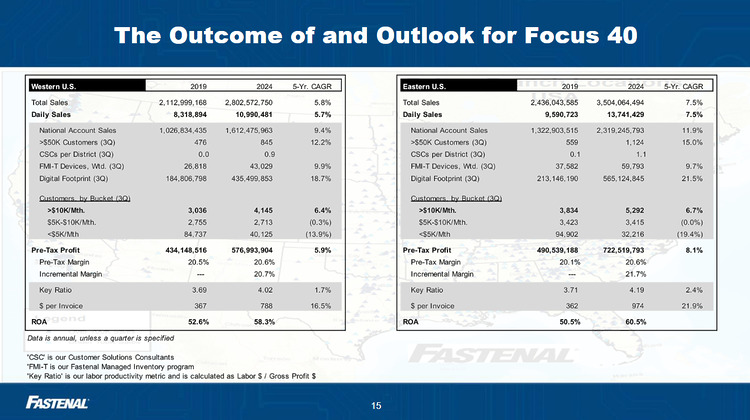

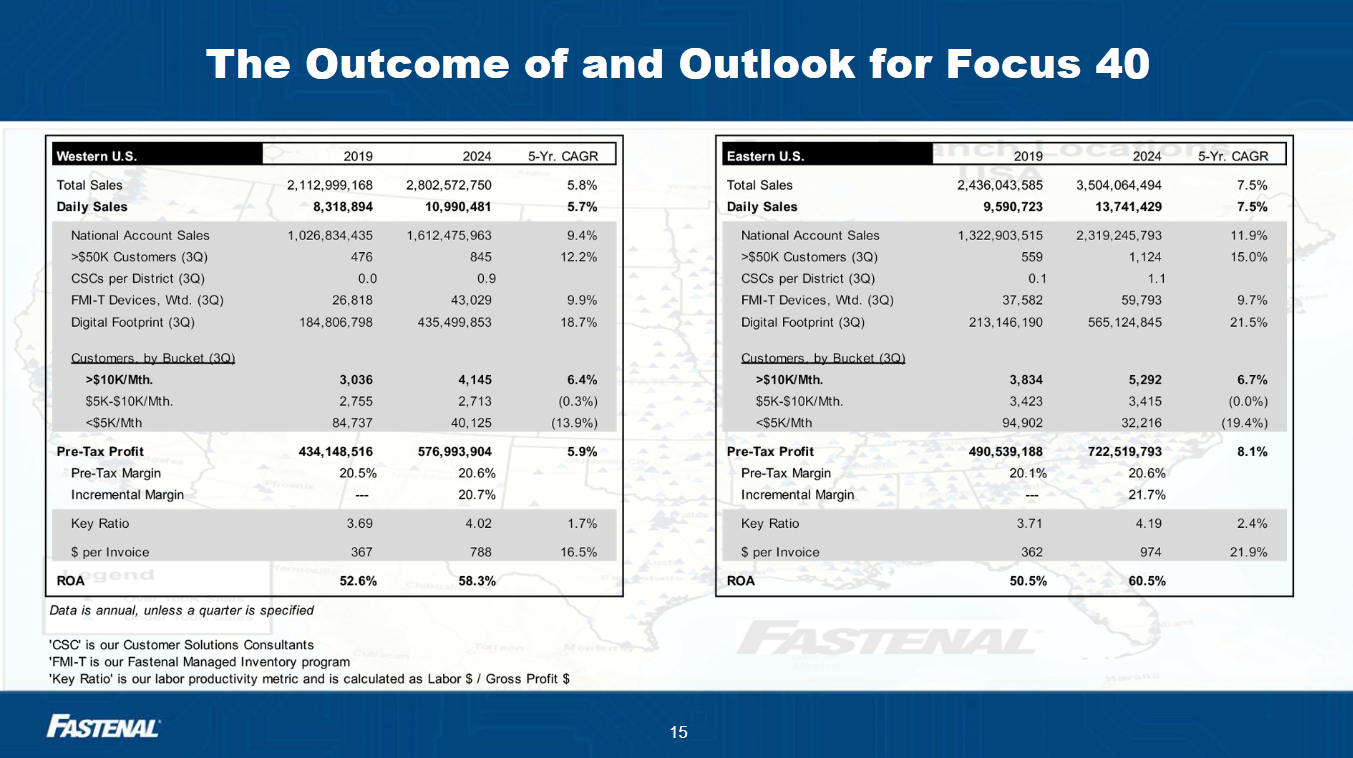

Sales Focus on Key and Target Accounts – In the above chart you can see Fastenal had 9,440 customers who spend $10,000.00+ a month in 2024 (In 2019 Fastenal had 6,870 accounts who were $10,000+). Those key account customers are growing significantly because they are getting called on and serviced by the Fastenal Team. At the top of the Fastenal sales pyramid in 2024 – 1,969 customers spending $50,000+ per month (up from 1,035 in 2019).

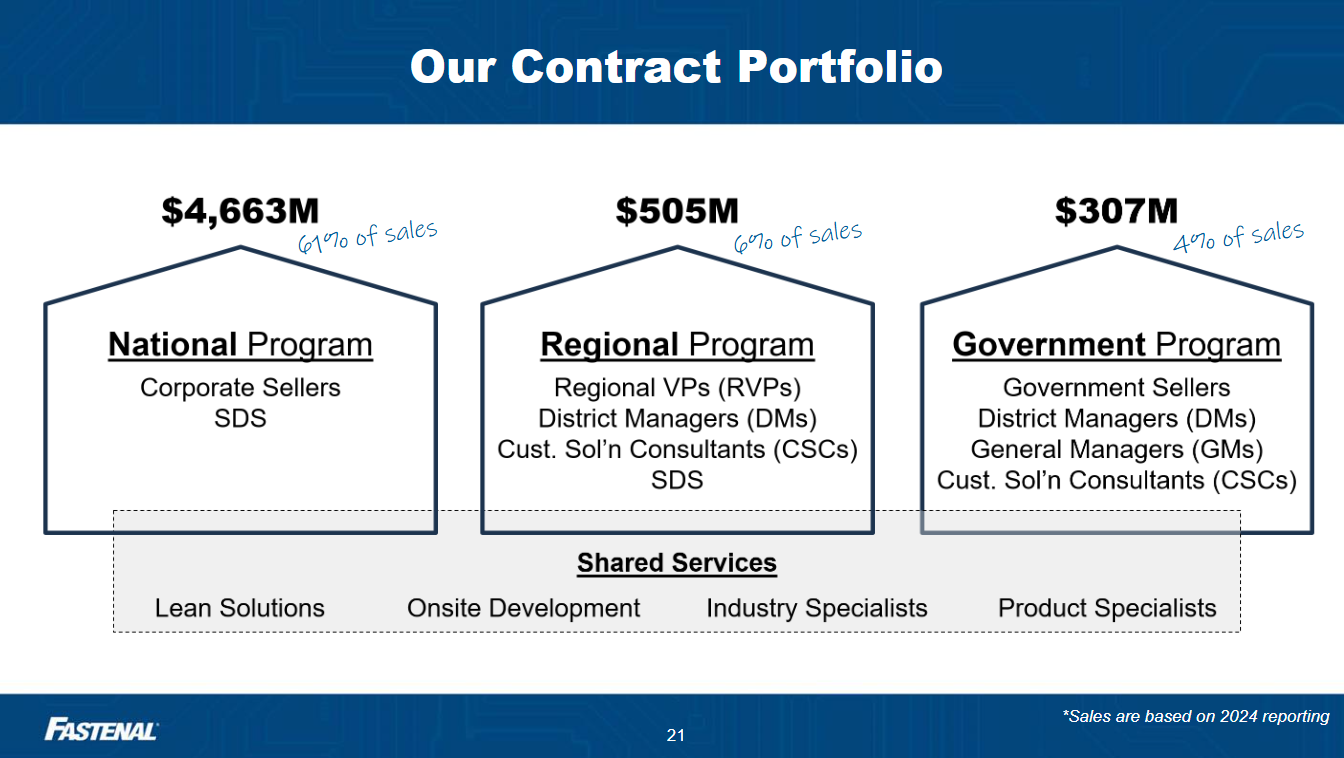

Sales Specialization with Solid Segmentation – Fastenal has a National Accounts team, Customer Solutions Consultants (1 per district today roughly for their roughly 170 districts), and a Target 5 Program that focuses on what I would call customers they have identified as “Must Haves” for their business.

I believe they have their “Hunters and Farmers” clearly defined in their sales process. The Customer Solutions Consultant (CSC) Hunter role is to acquire key accounts and then get those accounts to the right Farmer team. As Casey Miller shared the CSC is a growth orientated position “every year they start at zero” that is designed to acquire key accounts (accounts over that $10,000+ a month threshold). The CSC in the district they want to have sales skills equal to or better than the General Manager that leads the district. It is a true hunter role…not a part time hunting like many industrial distributors say their account management team is today. Most Account Manager roles for industrial distributors are primarily farmers where they service their customers. Serving your customers with excellent farmers is a vital role for all distributors, but many distributors are overweighted on farming vs. hunting in my experience.

The Fastenal General Manager sales focus is driven by the Fastenal Target 5 program. These are the 5 key customers in the General Managers area (likely the district) that Fastenal wants their local leader to upsell, service, and grow. The Fastenal National Account team I would predict likely has a team of experienced hunters who focus on calling on the General Motors and General Mills multi-location type nationals in North America and getting contracts signed. Then after the contract and commitment is secured, they are backed by a support team and their physical locations who do the gathering process to grow the business.

Fastenal shared the above slide on their Contract Portfolio which shows that in 2024 61% of their total sales was from their National Program (National Accounts) and 10% of their total sales was from their Regional and Government Programs. They support these selling teams with variety of shared services from Sales and Product Specialists, Onsite Support, Vending/FMI technology, Lean Solutions, Digital Programs and more.

It is clear to me that Fastenal has a clear segmentation plan in place and had made adjustments to their selling model… they need less people to handle orders and now have more people calling on customers to create orders.

And they track their performance and have their KPIs aligned with their tracking. On April 11th they shared an update to the market on their performance that ties directly back to their customers and sales segmentation.

“Looking at our Customer Site data, we had growth of 2.4% in the number of our $10K+ sites, led by Onsite-like sites (+6.9%). These sites accounted for 80.7% of sales in 1Q25, up from 78.9% in 1Q24. We continued to shed sites in our smaller categories, though the pace slowed. Average sales per customer site rose in every category, including very slightly in our $50K+ manufacturing sites which hadn’t grown since 1Q24.” Fastenal Investor Conference Presentation April 11, 2025.

Fastenal is tracking and reporting on their performance on accounts who spend $10,000+ and Month and customers who spend $50,000+ a month. It is likely that what you provide as tracking to the market is what KPIs your teams are measured on and spend their time focusing to achieve.

Is this Plan working?

In the first chart above Fastenal shares a number that just jumped off the page to me. $ per invoice – which has climbed about from $360 in 2019 to $788 in the West and $974 in the East Region.

That means more lines per order, better inventory turns, fewer people needed to pick orders, fewer warehouse pick tickets (All Pick tickets require sunk time and costs to process and fulfill each and every order)…..and much, much more. That metric screams out that Fastenal is getting more efficient and spending less time taking and fulfilling orders, and freeing up more time for Fastenal associates to sell and add value to their customers.

If you have thoughts or comments on Fastenal to share, please feel free to reach out as we appreciate your input greatly. There is much to learn as an Industrial Distribution Channel leader from the Fastenal story that may apply to your unique distribution business.

Leave a Reply