Distribution Solutions Group, which serves the MRO, OEM and industrial technologies markets, announced their 3Q 2025 earnings results on October 30, showing a stronger than expected 10.7% growth in total sales, to $518 million.

DSG Delivers Growth

Organic sales grew 6% and 3.1% sequentially, over 2Q 2025. It was highlighted that all segments grew, led by Gexpro Services and $23.3 million of incremental revenue from the three acquisitions they closed during 2H 2024.

DSGR delivered Consolidated Adjusted EBITDA of $48.5M and margin of 9.4% of sales versus 9.7% in Q2 on sales mix shift, initiative investments, and increased employee related costs.

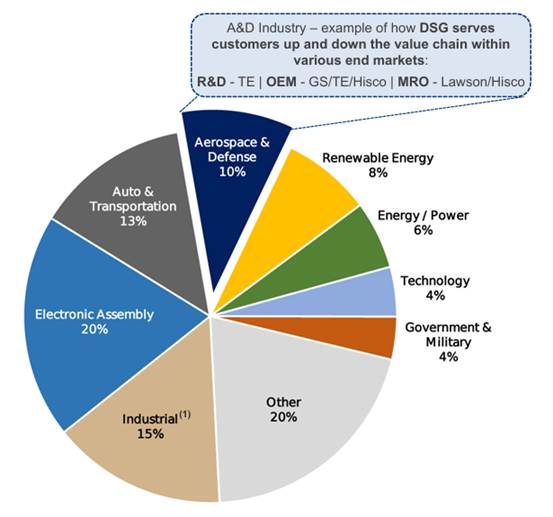

In terms of the macro environment, despite inflation, tariffs, and higher interest rates that challenged parts of the U.S. economy, momentum continues in key end markets, including aerospace & defense, technology, renewables, and positive ramp for industrial power.

However, tariff exposure continues and DSGR continues to work with customers to mitigate impacts. Management noted tailwinds like the Big Beautiful Bill and domestic manufacturing opportunities for U.S. customers seeking to avoid or lower the impact of tariffs.

Counter to some of the other distributors, momentum was built during the months of the quarter. “As the third quarter developed, September was our strongest month within the quarter as well. We saw acceleration improvements, average daily sales as we went from July into August and then into September.”

Also noted was that “this quarter had strong volume growth, not just revenue growth. That was for the first time across all of our verticals, we enjoyed volume growth again.” Revenue growth was driven by 1/3 price and 2/3 volume growth.

DSG Segment Insights

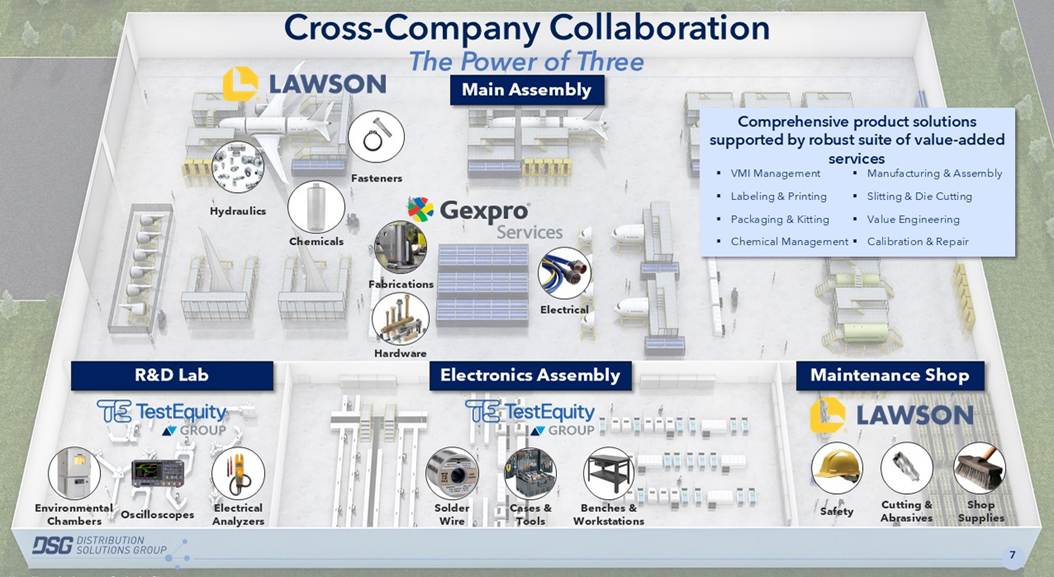

An interesting slide from an earlier investor presentation provides an illustration of how the 3 segments interact, and what departments within a facility they call upon:

Lawson Products (focused on the MRO market).

- Average daily sales (ADS) growth YoY (+3.0%); down sequentially -2.2% to $121.5 million. Lawson achieved organic growth across a majority of customer segments YoY while organic revenue was soft compared to prior quarter, something we have heard from other distributors. The Q3 adjusted EBITDA was $14.0M or 11.5% of revenue, reflecting sales mix shift, continued investment in sales transformation and digital tools and higher employee related costs all pressured margins. The Lawson sales force expansion continues and headcount ended September 30, 2025, with ~930 sales reps compared to ~860 a year ago.

- Lawson’s strategy is to “continue concentrating its efforts on increasing the productivity and size of its sales team. Additionally, Lawson drives revenue through the expansion of products sold to existing customers as well as attracting new customers and additional ship-to locations. Lawson also utilizes an inside sales team to help drive field sales representative productivity and also utilizes an e-commerce site to generate sales.”

Gexpro Services (focused on the OEM market).

- Q3 organic revenue was $131.5 million, up $13.2M or 11.4% from year-ago quarter on same number of days; organic average daily sales (ADS) was up 3.7% over 2Q 2025. Gexpro realized improvements in the renewable energy, aerospace & defense and industrial power vertical markets continues. Gexpro expanded net margins primarily through leveraging fixed cost structure over an increasing sales base, resulting in record adjusted EBITDA. Performance was driven by value creation initiatives including DSG cross sell, acquisition synergies and expanded VMI, kitting, manufacturing, and E commerce offerings. It was noted in the analyst Q&A that the sales cycle with Gexpro is long.

- Gexpro’s strategy is to “increase revenue through increasing wallet share with existing customers, customer-led geographic expansion, new customer development in its six key vertical markets and leveraging its portfolio of recent acquisitions to expand its installation and aftermarket services.”

Test Equity (focused on industrial technologies markets)

- This segment achieved Q3 average daily sales (ADS) of $206.479 million, up 5.8% from year-ago quarter on higher test and measurement and rental revenue; revenue was up 5.9% sequentially over 2Q 2025. Key operating initiatives are focused on expansion of service related offerings, continued acquisition integration, pricing disciplines, sales force optimization, digital channel expansion, and cost containment. Electronic production supply and industrial printing remain under pressure.

- Test Equity’s growth is fueled by their “comprehensive catalog of test and measurement equipment, electronic production supplies, and industrial tools, supported by a high-touch, consultative sales model. Strategic acquisitions have expanded its customer base and strengthened recurring rental revenue. We believe that continued investments in e-commerce, rising demand from high-growth sectors like aerospace and telecommunications, and Test Equity’s strong positioning as a preferred vendor amid supplier consolidation will contribute to sustained momentum and long-term value creation.”

By end market, DSGR has the following splits:

DSG Stakeholder Concerns

Concerns were centered around margin compression and profitability challenges despite strong revenue growth in a slow growth, inflation and higher interest rate environment Margin pressures were driven by increased employee-related costs, including healthcare expenses and workforce expansion, which management acknowledges as temporary but impactful on near-term profitability. In addition, some of the strategic investments in growth initiatives such as digital transformation, logistics infrastructure, and talent acquisition dilute margins in the short term.

DSG Guidance

Management issued cautious guidance for Q4 2025 due to anticipated seasonal challenges like fewer selling days (61 vs 64 in Q3), potential holiday shutdowns at customer sites, and rising labor costs that may further pressure margins.

Observation about DSG

When combined, DSG’s strategy appears to be:

- “Go wide” with the support of salespeople (Lawson)

- “Go deep” with services with Gexpro

- “Add valued services” with Test Equity

While each part works independently, they also work collectively and in collaboration.

Leave a Reply