Grainger reported 3Q 2025 results on October 31, 2025, with sales of $4.7 billion, up 6.1%, or 5.4% on a daily, constant currency basis.

Overall, the results show continued steady growth and profitability amidst muted market demand. While the current government shutdown may have some impact on Grainger, given that about 4% of sales are to the federal government, it would affect Q4. For Q3 government buyers may have a “use it or lose it” mentality since their budget expired on September 30th.

Grainger also reported that organic daily sales slowed during the quarter from +6.5% in July, +5.6% in August, and +4.3% in September. This has been a trend among other industrial / MRO distributors as well, including Fastenal and Applied Industrial Technologies, who all reported sales deceleration from July to September.

Perhaps this signals something about the industrial segment?

Grainger High-Touch … Key / Larger Customers

In the High-Touch Solutions – N.A. segment, typically “in-plant” and serving the Fortune 500 companies, sales were up 3.4% on both a daily and constant currency basis to $3.635 billion, driven by volume growth and improving price contribution as tariff costs are passed, despite a slow MRO market.

Gross profit margin decreased 50 basis points driven again by continued tariff-related inflation causing unfavorable price/cost timing and LIFO inventory valuation headwinds, which were only partially offset by positive mix and freight.

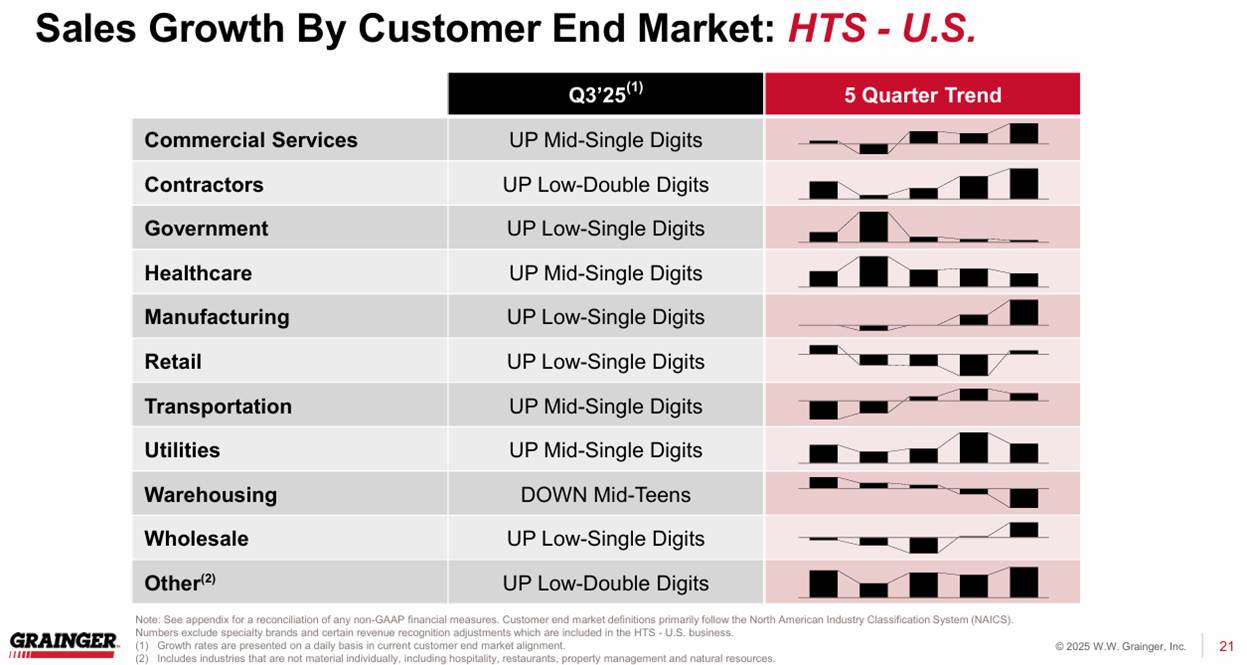

Growth in large customers was 3% and growth in mid-sized customers was 7% in the quarter. Sales growth in the quarter and over the last 5 quarters is shown in the chart from the earnings presentation:

Commentary during the earnings call mentioned that the Warehousing segment decline was due to one customer adjusting their contract.

Grainger Endless Assortment … Small Customers

In the Endless Assortment segment, what could be called, “non-Grainger branded” and historically small and mid-sized customers who purchase periodically, sales were up 18.2%, or 14.6% on a daily, constant currency basis, to $935 million, driven by strong performance at both MonotaRO (Japan), which grew 12.6% (in local days/local constant currency) and Zoro, which grew revenue 17.8% on a daily basis (e-commerce strong).

While some will say this shows the power of eCommerce, it is important to point out that this is a different customer segment … small customers … and that the segment is about 10% of Grainger’s overall business.

Digital selling is important as much of Grainger’s Hi-Touch business is also transacted via EDI, punch-out, their Keepstock program (Grainger’s storeroom management program) as well as vending machines.

Gross profit margin for the Endless Assortment segment increased 60 bps, driven by strategic pricing actions at Zoro and favorable mix at MonotaRO.

It was also noted in prior earnings that nearly 1/3 of Grainger business is in Manufacturing with another 16% in Government. With tariffs driving US industrial production (either increasing pricing or generating demand for US manufacturers), this could be beneficial for Grainger.

High-level input from Grainger’s earnings call:

- Zoro continues its momentum, driving efficiencies with marketing spend and working to further enhance the customer experience, including improved search, better fulfillment, and continued optimization of their assortment.

- “Zoro U.S. has been a pretty big shift in terms of performance—has been improved fundamentals on getting more attractive customers and then getting them to buy frequently. Average order size hasn’t really changed at all. It’s all been frequency of orders when you look at it. That’s been the driver. That’s been better customer acquisition. Acquiring customers with the right products gives us a higher probability of actually getting a repeat order. It’s also just doing better at marketing to those customers and creating a relationship through digital means.“ (The takeaway – eCommerce is about marketing and having the right product that is appropriate for online buying … knowing your customer!)

- At MonotaRO, sales growth remains strong with continued growth from enterprise customers, coupled with solid acquisition and repeat purchase rates with small and mid-sized businesses.

- Discussion on tariffs:

- “In the third quarter, we remained engaged in active dialogue with our supplier partners and used our September price increases to help offset continued cost pressure. While our initial pricing actions back in May only applied to a small portion of our products, largely those where Grainger imports the product directly, the September increase was much broader and included initial pricing actions on supplier-imported products where we had finalized negotiations. (Given that one month doesn’t make a quarter, with growth only 5.4%, and tariff pricing being an element of this, the real growth is nominal.)

- As we move into the fourth quarter, we’re seeing inflationary pressure continuing to build, including impacts from the recent Section 232 expansion.”

- Government shutdown is having an impact … and will impact Q4 sales!

- “we face current year headwinds from the government shutdown. However, if we just looked at the last two weeks of the month, which exclude the prior year hurricane impact, October total company sales are up in the 4% to 5% range on a daily constant currency basis, more in line with what we saw in the third quarter, but still reflecting the impact of the government shutdown, which is weighing on public sector sales.“

- Comments by management that business lost from furlough – “some of the non-military entities that we would serve are completely shut down. Typically, you wouldn’t see much of a catch-up from those.”

- “From a government shutdown perspective, it’s really the military so far that’s been hit and things like VA hospitals that are linked to federal that have had slowed down as well.”

- Discussion on private brand competition – “We don’t think we’re uniquely exposed or at a competitive disadvantage in private brand. What has happened with some of the larger tariffs is the difference between a private brand product in some cases and a national brand product can become very tight. We have decisions to make as to how much price we take in those situations. We’re still working through all of that. It’s a subset of our private brand. It’s not all of them. It’s not a huge portion of them.”

- On price increases begin

- “What I would say is that for a manufacturer, they have decisions to make about whether they pass % or dollars. I would say that a lot of them have passed somewhere in between that too in many cases. Just because the headline is 20% tariff increase, they may not pass 20% in all cases.”

Shareholder Concerns

There was concern over the earnings which have declined 38% year-over-year, as well as with operating margin pressures, which declined 460 basis points (above-mentioned tariff inflation and inventory valuation impacted – a great deal of discussion on the LIFO inventory valuation and impacts and timing). The exit from the UK market and divestiture of Cromwell raised some uncertainty about the overall impact on revenue.

An underlying concern remains the muted MRO market with inflation a headwind to demand.

Guidance

Management narrowed guidance, updating the full-year 2025 revenue guidance slightly to between $17.8 billion and $18.0 billion, down modestly from prior estimates of $17.9 billion to $18.2 billion. The company cited tariff impacts and the planned exit of the UK market as key factors influencing the updated guidance.

Takeaways

- Is Grainger’s slow MRO performance indicative of the market? Your performance? Their product mix?

- With Grainger now making price changes, what impact will this have on performance? Or does it also provide others an opportunity to increase their pricing?

- Will their Hi-Touch customers, many who have contracted pricing, accept price increases?

- Or are they losing share? If so, why? Is it price? Service?

- And if losing share, to whom? Fastenal? Independents? MSC?

- Is the industrial slowdown indicative of larger concerns?

Leave a Reply