Last week on June 4, 2025, at the 45th Annual William Blair Growth Stock Conference: Global Industrial presented some interesting insights into their business and strategy.

In these investor day presentations, you can get an excellent overview of an Industrial Channel Leader’s strategy that is more in-depth than a normal earnings call, so they are fun to analyze.

Global Industrial’s presentation was led by CEO Anesa Chaibi who joined the company recently in mid-February. I was excited to hear Anesa present as she was the leader of the largest business in HD Supply (when I was part of the HD Supply family of companies) and she led that business unit successfully for many years.

Global Industrial is a large industrial player that is similar in history to other “Catalog Houses” like Grainger, MSC Industrial, McMaster Carr, etc. in how they served the Industrial market. They have undergone a similar transformation from a catalog house into a digital leader.

Their business has traditionally been “very much steeped in the industrial equipment and supplies portion in the MRO, total addressable market.” as Anesa Chaibi shared.

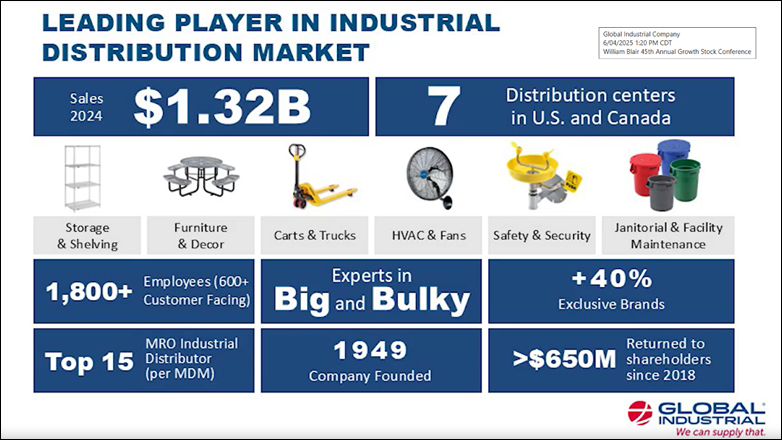

Source: Global Industrial June 4, 2025 – William Blair Conference

With $1.32 Billion in Sales (2024) served by 600 customer facing associates, the sales per customer facing associates is an average of $2.2 Million annually.

What makes them different inside Industrial Distribution and unique as they shared is that they historically “been very much niche-focused in the big and bulky segments” said Anesa Chaibi.

Global Industrial customers range from manufacturing, wholesale, transportation, health care, hospitality, and in the public and private sectors. They have a very wide range of customer segments they serve.

In answering a question on how Global compared to the competition, I though Anesa Chaibi answer gave great insight “if you think about maintenance, repair and operations, MRO, we’re primarily in the O” (Operations). Global further shared how they “have the potential to be able to extend beyond that and to really focus on maintenance and repair, and having those product lines to be able to take to market.”

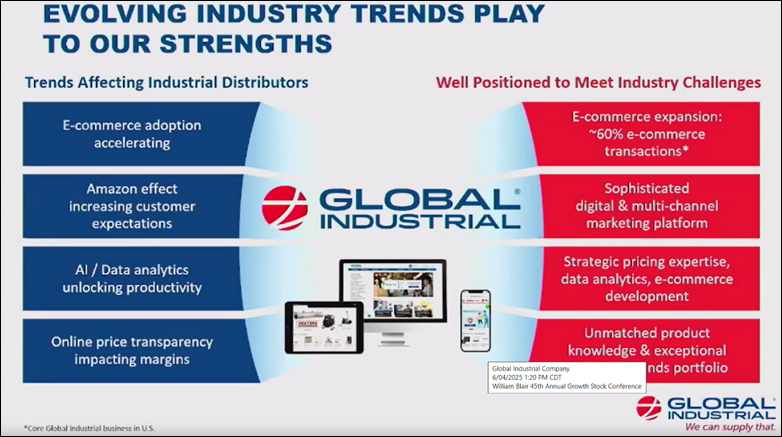

Source: Global Industrial June 4, 2025 – William Blair Conference

The 40% of total sales being exclusive brands for Global Industrial is an impressive number for the B2B Industrial and Construction channel.

I find it informative that Anesa Chaibi led HD Supply Facilities Maintenance for many years (now owned by Home Depot) which had a very large exclusive brand business percentage. The hiring of an experienced leader with years of exclusive brand experience inside distribution seems like a natural fit for the Global Industrial business.

The Global team shared their private label brands deliver a premium margin of 15 to roughly 20% over the national brands that they distribute and carry, and have expanded those product lines and those categories into the marketplace.

The term Global used about “extra chip in the cookie differentiation” is an effective way to express their focus on adding value-added features and functionality into many of their private label product lines.

“We primarily go to market and deliver through, less than truckload shipments, and third party carriers. We are very ecommerce centric. Over 60% of our transactions are online and have been for quite some time, and 40 plus percent of our revenue is tied to exclusive brands.” said Anesa Chaibi

Source: Global Industrial June 4, 2025 – William Blair Conference

The breadth of customers that Global serves of >400,000 provides ample opportunity to grow share at the customer level. The webcast did not share if their customer count is an annual average or cumulative over a period time, but if we guess that is an annual customer number an individual customer only spends on average $3,300.00 per year. That indicates ample share growth opportunities across the customer base they serve today.

One quote that jumped out on the share growth potential was “over 400,000 plus customers, what is unique to us is we don’t have a lot of customer concentration. It is less than 2% of any one customer. So, there’s an opportunity there as we look future forward, to gain greater share of wallet.” Anesa Chaibi shared.

Source: Global Industrial June 4, 2025 – William Blair Conference

One effective way to expand wallet share is by expanding your product lines and entering new customer verticals as Global Industrial made clear is part of their strategy.

Improving the customer experience and making it easy to do business, can create barriers to exit for customer.

Tex Clark, CFO, Global Industrial shared how Global uses digital as a key differentiator “We’ve always been e-commerce first. I mean, if you go back in history, we were a cataloger that really converted into an e-tailer. We think about electronic ordering and e-commerce. We think actually beyond e commerce, we think overall e-orders, that connectivity with our customers through EDI, CXML, punch out catalogs, really making sure we’re connecting to our customer efficiently as possible with them.”

So, how is Global Industrial uniquely positioned in the marketplace?

They have a strong customer-facing team (Inside Sales primarily) backed by strong digital tools (60+% ecommerce transactions) that serves their extensive customer base with “big and bulky” solutions

As Anesa Chaibi shared “You know, e-commerce adoption it’s a significant portion of how we go to market. It’s an omnichannel approach that we take across all the verticals and the segments we serve.”

Global prides themselves on doing business with their customers with an omnichannel sales approach: Digitally, EDI, Punchouts, inside sales support, etc. that serves its customers on an ongoing basis. Their exclusive brands are a key part of their mix, as these brands are integral to their business and deliver strong margins that allow for continued investments in the business.

As Tex Clark Global Industrial CFO, shared “if we think about our distribution network, a little over half of our revenue will come out of our DC profile. But because we are capital and light durable, our durable and light capital primarily goods, we’re planned purchases.”

This quote indicates their stock and direct ship (from a manufacturer direct to the end user) mix is about 50/50, and the key phrase about “planned purchases” illustrates the need for quality Global personnel to help their end customers choose the right solutions, buy it, and then have them delivered often by third party carrier to the customer.

Global Industrial is in my opinion a good example of a distributor that has found the right mix of human and digital support to serve their customers and uses their knowledge and experience to be that “Big and Bulky” channel leader distributor.

It will be interesting to see where Global Industrial continues to evolve, driven by their end customers’ needs.

P.S. The Global leadership team on the call spent ample time talking about their NPS surveys, customer surveys, and feedback loop that they use to stay relentlessly focused on the end customer. That is a great foundation to build their business on.

Key Takeaways for the Industrial Channel

Global Industrial’s key growth pillars and plan are easy to understand and follow. I assume that this is conveyed and understood by their associates (conjecture on my part or course). This to me says….1. Global knows who they are….2. Global associates know the value they bring to end customers…3. and the Global sales team can convey that value proposition effectively to their end customers.

I know it sounds simple to do, but it is actually often hard to do for many industrial channel leaders. Can your team do the same 1. 2. 3 for your business?

Digitally as a former “print catalog house” that has successfully transitioned to digital shows they are strong digitally, so they are likely ahead of many competitors in the channel.

Where is your manufacturer or distributor business at today digitally, and your sales coverage mix?

Tex Clark shared his thoughts on digital/ecommerce with a mix of human sales and support on the channel that were enlightening…..

“But what we find in such a fragmented industrial distribution market is that there’s still such a long tail of competitors that still are nascent into ecommerce. To us, it feels like ecommerce, it should be second nature, but, again, so many that are still, virtual only, one-to-one sales only, they don’t bring that full omnichannel approach to their business.”

If that quote might fit your distribution business, or you have a lot of distributors you serve who are “old school”. It might be time to get thinking about how to improve that.

As always, we appreciate your comments and support. jgunderson@channelmkt.com

Leave a Reply