The Winona, Minnesota based wholesale distributor of industrial and construction supplies, announced 3Q25 earnings on October 13. Revenue grew 11.7% from prior year to $2.13 billion and gross margin grew 40 basis points to 45.3%. Revenue growth was driven by increases in customers and unit sales, especially in customers spending >$10k per month, and market share gains.

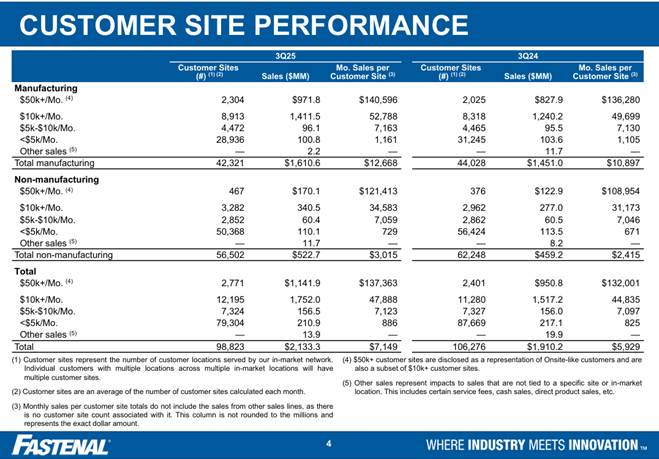

However, SG&A expenses also grew 11.5% in the quarter, raising some concerns with shareholders. 3Q operating profit was $441.5 million, growing 13.7% on margin of 20.7% (+40 bps year-over-year) and net profit grew 12.6%. In the previous quarter, we showed the Daily Sales Rate Growth, which has continued its climb from 4Q24’s 2.1% to the 11.7% this quarter, but there is an interesting story in the customer profile, as shown below:

To summarize, Fastenal improved sales in both Manufacturing and Non-Manufacturing segments in the especially in the $50k/month (+15.4% y-o-y) and $10k/month sites (up 8.1% y-o-y). The $10K+ sites accounted for 82.1% of sales in 3Q25, up from 79.4% in 3Q24. Average sales per customer site rose in every category, including our $50K+ manufacturing sites.

Despite sluggish manufacturing markets, the performance reflects the contribution from improved customer contract signings, favorable foreign exchange rates (contributing 10 basis points to sales), an increase in unit sales driven by growth in the number of customer sites spending $10k or more per month with Fastenal and, to a lesser degree, growth in average monthly sales per customer site across all customer spend categories and combined with product pricing, contributed increase of 240 to 270 basis points,

By end market, Fastenal has four categories: heavy manufacturing, other manufacturing, non-residential construction, and other (reseller, government/education, transportation, warehousing and storage, and data centers). The manufacturing end markets outperformed primarily due to the relative strength with key account customers with significant managed spend leveraging the Fastenal service model and technology. This tends to benefit manufacturing customers. The non-residential construction end market experienced growth for the second time in twelve consecutive quarters. Other end market sales were favorably impacted by growth with education and healthcare, transportation, and data center customers.

From a product standpoint, Fastenal operates in three categories:

- Fasteners (including fasteners used in original equipment manufacturing (OEM) and maintenance, repair, and operations (MRO)

- Safety supplies and

- Other product lines, including 8 smaller product categories, such as tools, janitorial supplies, and cutting tools.

While industrial production was sluggish in 3Q, and management cited that the US manufacturing sector remained in contraction—reflected by a Purchasing Managers’ Index (PMI) reading below 50—creating a challenging demand environment. Despite the macro environment, the performance of the fastener product line outperformed non-fastener product lines (up over 15% in September). The fastener category experienced improved growth, driven by easier comparisons, increased contribution from large customer signings, better product availability in distribution centers, and pricing actions implemented during the second and third quarters. Digital sales accounted for over 60% of total sales.

During the call, management emphasized cost control and product availability, particularly in the fasteners category, to maintain margins amid weaker end-market demand and tariff headwinds, and cited pricing delays and customer “price fatigue” as short-term profitability pressures but reaffirmed long-term growth plans through expanding national accounts and e-commerce initiatives.

Outlook

Fastenal expects a muted demand environment through late 2025, but anticipates better industrial momentum in 2026 as policy clarity improves and investments in U.S. manufacturing revive order activity. Management also warned of potential risks from tariffs, manufacturing volatility, and possible extended holiday production shutdowns.

Stakeholder Concerns

Some concerns were raised over margin as Fastenal has burned through most of its pre-bought inventory into Q4 and additional purchases will be at higher costs. Management stated that between the most recent price increase & supply chain, it can cover current tariff costs. Additionally, there were concerns over higher SG&A costs, driven by salary, which were primarily withheld 2023 and 2024 bonuses that were paid out.

Another concern was around softening FMI adoption as Fastenal’s Fastenal Managed Inventory (FMI) device signings declined by 10.2% year-over-year. This prompted some revisions to 2025 targets.

The macroeconomic environment remains a concern withindustrial activity sluggish and interest rates high, some fear that any prolonged slowdown could pressure contract-based sales, which grew 11% in the quarter and pressure margins. Therefore, cost control is an issue, and some apprehension that growth may be front-loaded and that execution risks could heighten if manufacturing trends worsen.

Key Observations

Fastenal continues to be among the healthiest distributors with strong revenue growth. We will monitor the earnings calls of their peers over the next weeks. Analysts suggest that while the company retains long-term strengths—such as its Onsite program (adding 93 new clients in Q3) and digital transformation initiatives—investors will demand clearer evidence of sustained cost control, inventory optimization, and margin protection before sentiment stabilizes .

Will industrial end markets continue to soften with no recovery in 2025? Can Fastenal continue with market share gains, and can they maintain above-market growth, as they have in the past? Will Fastenal continue to be able to offset any gross margin contractions with supply chain investments, automation and other productivity investments?

As always, we appreciate your comments and support.

Leave a Reply