Last week I was on a fun webcast where Mark Jackmore CEO of Precision, and I were diving into real-world examples of how manufacturers and distributors could use data more effectively to report progress and take meaningful action together to improve their business.

We covered a lot of ground on the webcast, shared best practice examples, and tactical information on how you can improve and grow business on both sides of the fence (whether you are an industrial manufacturer or distributor).

One area that jumped out as we were presenting clearly that is often overlooked is: The reporting that both sides of the fence provide to each other is often lacking to actually help grow the business.

It sounds simple, but I can share from my category management experience on leading distribution teams, we excelled more often when we started delivering data in report cards that were meaningful and actionable.

As we improved our Scorecards and reporting we improved our business from a C+ to Honor Roll performance over time.

That is what excited me about the webcast. If you want to watch the full webcast, you can sign up to view the recording by clicking this link here,

Reporting Best Practices for Industrial Leaders

So, that sounds easy and something you might consider “consultant speak” Better data and scorecards = Better performance, but where do you start.

I suggest following a process as follows-

- Start with where you are. What Scorecard and reports are you providing as a distributor and manufacturer to your partners today?

- Take out a highlighter and highlight only the metrics you share that can really drive sales forward, or improve the proper depth of your inventory that improve first-time fill rates. Rank those if you can from highest to lowest.

- Revise your scorecard to only have the highest ranked highlighted metrics considered for page one. Move the others off page 1 to the appendix.

- Add “other metrics” that you are missing that help achieve Item #2 above

- Move everything else you are tracking today to the appendix, and focus the majority of your efforts on the metrics on the front page of the scorecard.

That was the process we used and followed at some of the largest distributors in North America when I was on those teams. It is also the process I use with all the distributors and manufacturers we work with today at Channel Marketing Group.

I’ve found when you finish that 5-step process the one area where you often get stuck is item #4. What metrics do I need to use to add to the front page of my scorecard that can really drive sales forward, or improve the proper depth of your inventory to improve first-time fill rates?

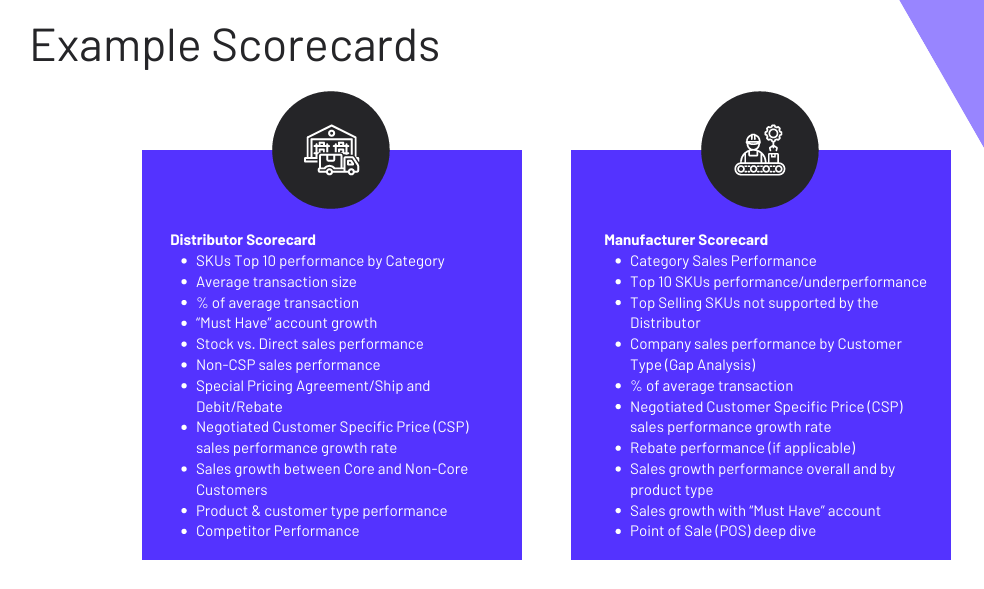

The above example is one I have been using in presentations for distributors and manufacturers. It has some examples to consider for items you “might” bring up to Page 1 of your scorecard that are all tied to driving sales forward, or improve the proper depth of your inventory to improve first-time fill rates.

If you look at the above graphic you might see a metric that makes sense for you to add to the front page.

The goal is to have a system, process, and scorecard approach that can give you a report for any level (30,000 ft, 15,000 ft, or ground). You want to react quickly to any need, and get the information to your key leaders and stakeholders quickly.

Mark Jackmore had this great quote from our webcast that I loved (one of many good insights on the webcast)

“I think the sharing of data between a strategic supplier and distributor is critical because growth heals a lot of wounds and it’s a tougher macro environment that industrial distribution suppliers are facing right now Growth opportunities are typically share gain, So, the willingness to share information to figure out a growth strategy. Is of critical importance.”

So, what is the magic formula for building great scorecards?

There is no “one way to success” to create a universal scorecard for any channel business I have worked for and with today. I and our team at CMG, has seen and helped refine 100+ scorecards for distributors and manufacturers. Each one is different based on where they are today, what data can you get access to, what you are willing to share, and more.

My advice is to use the above 5 steps we outlined internally and create a scorecard yourself. Then after you have that complete, talk to someone else outside your organization for input, brainstorming, and best practices to consider.

Then develop your test scorecard after those two steps and use it in your meetings. Then fail fast….if a metric you added doesn’t hit or help with your channel partner, drop it and fail fast. Add another new metric that you think will resonate and then use that one for your next meeting. As so on….

Over time, you will find the right scorecard(s) that resonate and drives sales and market share growth, that also improve your inventory position. I used the term scorecard(s) because I have found that you need to vary that core scorecard with tweaks and metrics that matter to that “partner” whom you are meeting with that day.

It is not easy to move from a C+ to the honor roll of course as a channel leader. It takes time and effort, but one key foundational element that can help is the data and scorecards you use with your channel partners. Good things happen from good conversations when reviewing the right scorecard.

I would love to hear your thoughts and comments, and if you want to reach out and talk scorecard development, please feel free to email me anytime. As always, we appreciate your support. jgunderson@channelmkt.com

Leave a Reply