The 3M Q4 2025 earnings report delivered solid numbers, but the story that matters for industrial distributors goes beyond the headline figures. The Safety and Industrial segment outperformed the rest of the company, innovation is accelerating, and management is openly discussing potential divestitures of product lines that sit in a lot of distributor warehouses. If you are planning your approach for 2026, the signals coming out of Maplewood deserve attention.

The Numbers

3M announced Q4 2025 earnings on January 20, 2026. Revenue came in at $6 billion, representing organic growth of 2.2%, driven by commercial execution and new product launches. Operating margin of 13% was down 510 basis points due to restructuring, transformation costs, and litigation expenses. But adjusted operating margin hit 21.1%, up 140 basis points, showing that the core business is strengthening through better product mix, improved execution, and cost discipline.

CEO Bill Brown highlighted the accelerated pace of innovation, with 284 new products launched in 2025, a 68% increase over 2024. That momentum is expected to continue with 350 new product launches planned for 2026, supporting both growth and pricing power.

Safety and Industrial: The 3M Q4 2025 Earnings Bright Spot

The Safety and Industrial segment, which accounts for roughly 40% of total sales, delivered one of the strongest performances across the company. This is the segment where most products that industrial supply distributors stock are manufactured: industrial adhesives and tapes, abrasives including Scotch-Brite, personal protective equipment, filtration products, and supply chain solutions.

During Q4, Safety and Industrial grew organic sales 3.8%, the strongest segment growth among 3M’s major business units. Growth was supported by industrial adhesives and tapes (high single-digit growth), abrasives (mid-single-digit growth), and personal safety products (high single-digit growth). Drivers included improved industrial demand in manufacturing and automotive production, pricing discipline that helped offset input cost pressures, and strong execution in distribution channels, particularly in North America.

For the full year, Safety and Industrial grew organic sales 3.2%, exceeding the company’s overall organic growth rate of 2.1%. Roofing granules was the weak performer, reflecting softness in the consumer segment.

The Divestiture Watch

Here is where distributors and reps need to pay close attention. At the Morgan Stanley Laguna Conference in September 2025, Brown indicated that 3M could sell off some of its “commodity-like” industrial divisions in coming years. Bloomberg has since reported that 3M is exploring the sale of multiple industrial units, working with Goldman Sachs to divest certain assets in a move aimed at streamlining operations and shedding slower-growing segments.

The most likely candidates include abrasives and industrial tapes sub-units, aftermarket automotive products, and certain personal safety product lines that are more commoditized.

For distributors carrying these lines, the ownership question matters. A divestiture could mean new manufacturer relationships, different channel strategies, or shifts in pricing and support. This is not something to panic over, but it is something to monitor.

What Management Expects in 2026

Management is guiding toward sales of approximately $25.25 billion, implying 3% organic growth. Margin is expected to grow to around 24.1% from the 23.4% realized in 2025. Productivity initiatives, mix improvement, and scaling of new product launches are expected to drive margin improvements.

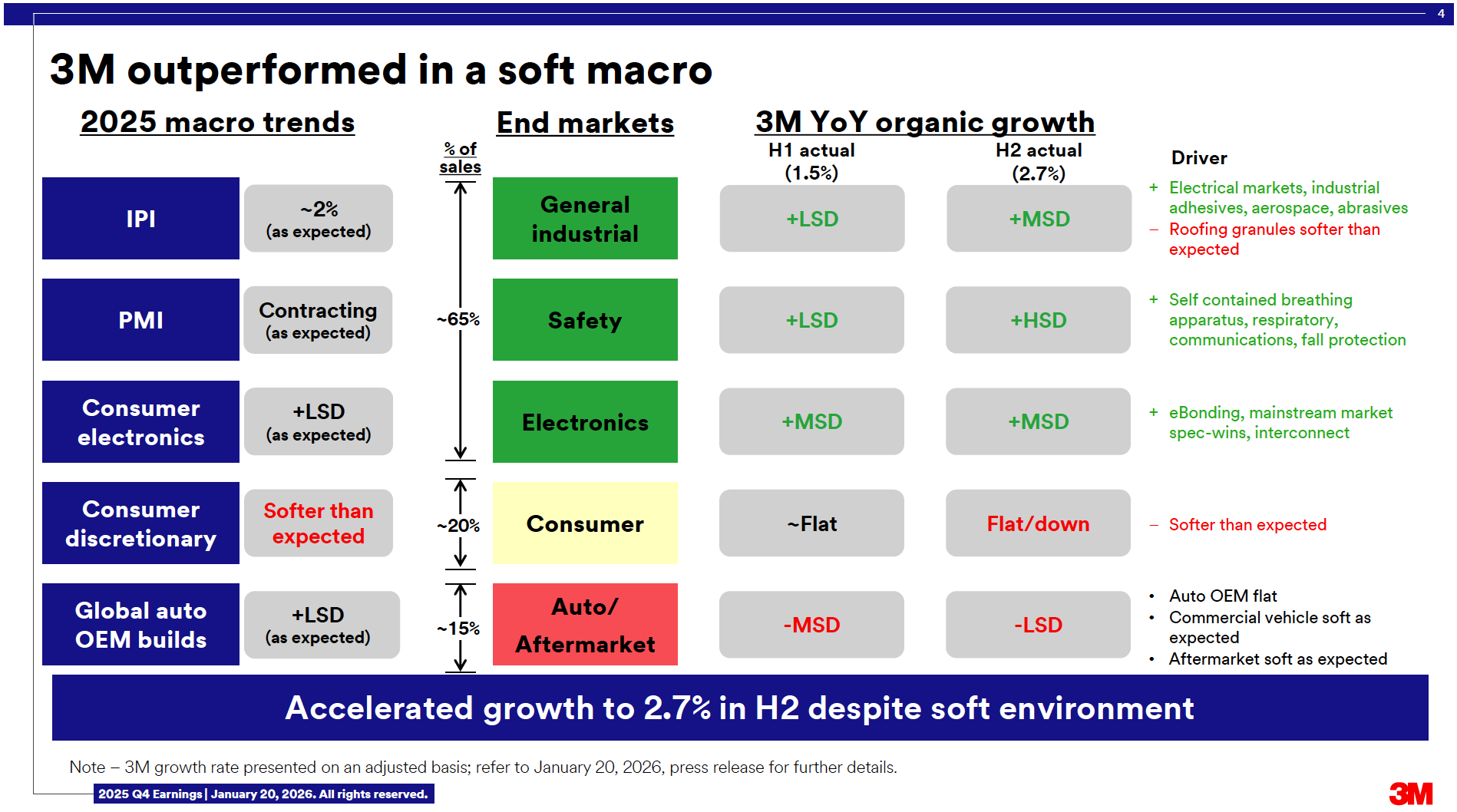

By end market, 3M sees improvements in industrial, safety, and electronics, with a flat consumer outlook and weak auto end markets. The macro environment remains soft, with flat US industrial production expected, which poses challenges for growth. The company also anticipates continued headwinds from PFAS-related costs and tariff impacts.

What This Means for Distributors

The innovation pipeline is real. With 350 new products expected in 2026, distributors should be talking to their 3M reps about what is coming and how it fits their customer base. New products can drive margin and differentiation if you are early to market with them.

The divestiture risk is also real. If you have significant exposure to abrasives, industrial tapes, or aftermarket auto products from 3M, it is worth thinking through what a change in ownership might mean for your business. That does not mean pulling back today, but it does mean staying informed and having contingency thinking in place.

The Safety and Industrial segment continues to outperform, which validates the opportunity for distributors focused on industrial and safety markets. The question is whether you are positioned to capture it.

f this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

Leave a Reply