Fastenal closed out 2025 with accelerating momentum, posting double-digit sales growth in Q4 while navigating margin headwinds tied to its large-account strategy. The Fastenal Q4 earnings report, released January 20, showed quarterly revenue up 11.1% year-over-year to $2.03 billion. But the numbers also revealed the tradeoffs embedded in the company’s growth model: gross margin fell 50 basis points to 44.3%, driven by mix shift toward lower-margin contract customers and timing-related inventory costs.

Q4 Results at a Glance

Revenue grew 11.1% to $2.03 billion. Operating profit reached $384 million on a 19% margin, both up year-over-year. Net profit of $294 million increased 12.2%. The gross margin decline was driven by higher cost of goods sold flowing through in Q4 as certain inventory-related working capital was relieved. Supplier rebate timing also contributed to margin pressure.

Full-Year 2025 Performance

For the full year, sales reached a record $8.2 billion, up 8.7% from 2024. Daily sales increased 9.1%, while gross margin of 45.0% dipped 10 basis points. Operating profit of $1.66 billion on 20.2% margin grew, and net profit of $1.26 billion increased 9.4%. SG&A expenses continued to climb, a trend that has raised concern among shareholders. This continues the pattern of strong revenue growth Fastenal has delivered in recent quarters.

Fastenal Q4 Earnings: What Drove Growth

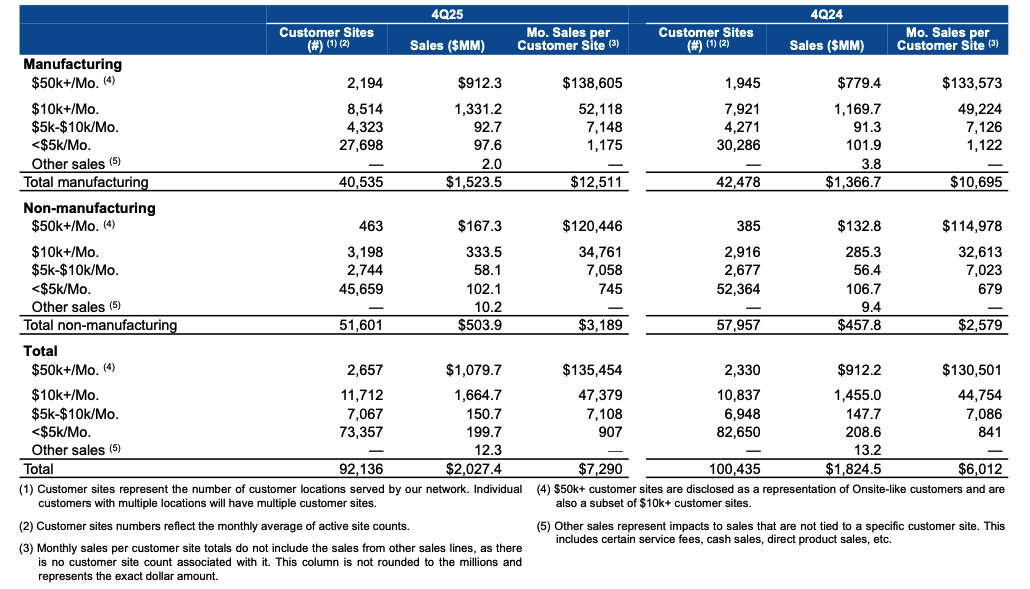

Several factors combined to deliver the 11% year-over-year sales growth. Pricing power alone added 310-340 basis points. Manufacturing customers grew 13%, providing strong tailwinds, while non-manufacturing demand rose 10%. Active customer sites spending $50,000 or more annually grew 14%, driving volume even as those accounts carried lower margins.

Digital channels continued to expand. E-business sales grew 6.4% year-over-year, and FMI (Fastenal Managed Inventory) technology accounted for 46.1% of Q4 sales. Fastenal now has an installed FMI base of about 136,600 devices, up 7.6% year-over-year, with roughly 25,900 devices signed during 2025.

The Large-Account Tradeoff

Fastenal leaned further into large contract accounts, boosting revenue but compressing gross margin. Growth was especially strong among customers spending more than $10,000 per month, reflecting deeper penetration into larger accounts. Meanwhile, revenue from customers spending under $5,000 per month fell 11%, reducing a historically high-margin contributor and shaping the margin results.

End Markets and Product Mix

By end market, Fastenal breaks out four categories: heavy manufacturing, other manufacturing, non-residential construction, and other (which includes reseller, government/education, transportation, warehousing and storage, and data centers). Manufacturing end markets outperformed, primarily due to strength with key account customers leveraging Fastenal’s service model and technology.

From a product standpoint, Fastenal operates in three categories: fasteners (including OEM and MRO applications), safety supplies, and other product lines covering tools, janitorial supplies, cutting tools, and more. Management did not break out product category performance on the call, focusing instead on customer segments, pricing, and sales channels.

Notably, U.S. industrial production remained sluggish throughout 2025. The December manufacturing PMI came in at 47.9, marking the 10th consecutive month of contraction and the lowest reading of the year. Fastenal’s results came despite that macro headwind, not because of a broad industrial recovery.

Outlook for 2026

Management signaled a cautious but constructive outlook. The company expects continued sales growth supported by pricing and large-account momentum, but also warned of higher investment spending and an industrial environment that remains uneven. The Fastenal Q4 earnings results position the company well heading into 2026, but execution will matter more than macro conditions. Growth will depend on large-account momentum, pricing power, technology-enabled sales channels, and market share gains rather than broad industrial tailwinds.

Stakeholder Concerns

Analyst questions centered on margin pressure, small-customer weakness, uneven industrial demand, and rising operating costs. Analysts pressed management on why gross margin continued to face headwinds despite strong top-line growth. Drivers discussed included the mix shift toward large contract customers, which carry lower margins, and higher unit volumes not fully offsetting margin dilution. Pricing contribution helped but did not fully offset the pressure.

Concerns were also raised around operating leverage and margin stability, especially given the trajectory of SG&A. Higher labor costs and increased investment in technology and on-site programs will continue into 2026.

Fastenal recently announced that CEO Dan Florness will step down in July 2026. While not a major focus of the call, stakeholders are aware of the transition and its potential implications for strategic continuity.

Observations

Fastenal enters 2026 as one of the strongest operators in industrial distribution, combining double-digit sales growth, a dominant technology footprint, and a contract-heavy revenue base. But it also faces margin pressure, rising costs, and a still-uneven industrial backdrop. The company’s competitive position remains solid, supported by digital scale and customer lock-in, though peers like Grainger and MSC are executing well.

The key questions heading into 2026: Can Fastenal maintain above-market growth as it has in the past? Will the company continue to offset gross margin contractions with supply chain investments, automation, and productivity gains? And will competitors close the gap on FMI, which now accounts for 46% of sales and creates significant recurring revenue and customer stickiness?

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

About the Author

Kevin Coleman is a contributor to Industrial Supply Trends.

Leave a Reply