MSC Industrial revenue growth of 4% in Q1 2026 looks healthy on the surface, but the details underneath tell a more nuanced story. The distributor, one of the largest metalworking and MRO suppliers in North America, reported results on January 7 that beat earnings expectations while simultaneously raising questions about demand fundamentals. For industrial distributors and channel partners watching the broader market, this report offers a useful benchmark for where pricing power, volume trends, and strategic priorities may be headed in 2026.

Q1 2026 Results: Pricing Carries the Load

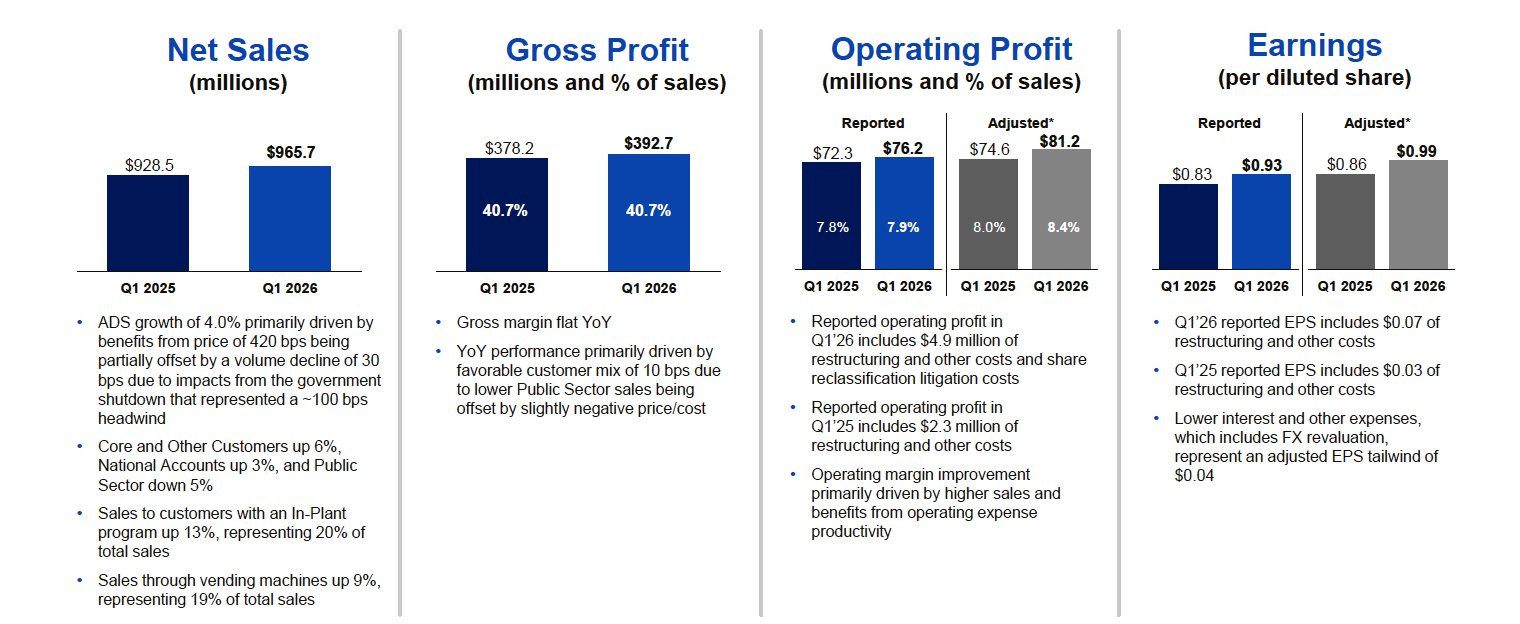

Revenue reached $966 million, with average daily sales also up 4%. But the composition matters: 4.2% came from price increases, while underlying volumes contracted 0.3%. A 1% headwind from the federal government shutdown contributed to that softness, but even without it, demand was essentially flat.

Gross margin held at 41%, supported by what management called strategic pricing discipline. That margin stability is meaningful in a period when supplier cost increases continue to flow through the system.

Segment Performance: Core Customers Lead

Core customer growth, defined as mid-market manufacturers, increased 6% and outperformed company-wide sales for the second consecutive quarter. E-commerce marketing and sales optimization drove much of that momentum. National accounts grew 3% year-over-year. Public sector sales declined 5%, directly attributed to the federal shutdown, which created the 100 basis point headwind to total revenue.

Solutions programs, including vending and implants, continued to outpace total company sales. The installed vending base grew 9%, and daily sales to implant program customers increased 13%. These embedded programs now represent approximately 40% of total sales. Web channel performance showed mid-single-digit growth in average daily sales, with improved conversion rates.

Leadership Transition

MSC announced Martina McIsaac as CEO. McIsaac previously served as COO and held leadership positions at Hilti and Avery Dennison. Her stated priorities include renewed focus on core customer engagement, optimized sales structures, and elevating company culture to support profitable growth.

Strategic Initiatives and Cost Structure

Management emphasized continued progress on growth initiatives and stable end-market demand. The company is deepening customer integration through embedded supply chain programs and vending systems. AI-driven inventory optimization is projected to generate $10-15 million in annual savings by 2026. Continued investment in e-commerce platforms aims to drive higher digital order penetration, with enhancements to digital tools supporting customer self-service and procurement automation.

Shareholder Concerns

Analyst questions centered on margin pressure, volume softness, macro uncertainty, and the federal shutdown impact. The core concern: how sustainable is pricing-led growth in a soft industrial environment? When 4.2% of your 4% growth comes from price, the underlying demand picture is fragile.

Several analysts questioned whether inflation normalization would erode pricing power. Others probed whether high-touch solutions and embedded programs were growing fast enough to offset mix pressure from lower-margin categories. Customer caution and elongated purchasing cycles emerged as recurring themes.

MSC Industrial Revenue Growth Outlook

MSC Industrial revenue growth guidance calls for 3.5%-5.5% year-over-year, slightly below prior guidance of 4%-6%. The adjustment reflects seasonality and approximately 50 basis points of revenue shifting to Q3 due to a major supplier conference. Adjusted operating margin guidance calls for a 50 basis point improvement to the 7.3%-7.9% range. Gross margin guidance was trimmed 20 basis points to 40.8%, factoring in negative public sector mix.

On pricing, management expects mid-to-high single-digit price increases from metalworking suppliers in January, impacting roughly 15% of total sales. Price growth in Q2 is expected to run a little north of 5% year over year.

Company Overview

MSC Industrial, headquartered in Melville, NY, operates across three primary segments. Metalworking remains the largest, driven by cutting tools, abrasives, and machinery for fabrication and machining operations. Q4 2025 metalworking revenue was approximately $600 million. MRO includes safety supplies, fasteners, janitorial items, and PPE, with Q4 2025 revenue around $250 million. Other product categories including bearings, power transmission, hand and power tools, fluid power components, and electrical supplies contributed approximately $75 million in Q4 2025.

What This Means for MSC Industrial Revenue Growth

The question facing MSC, and by extension much of industrial distribution, is whether pricing-led growth can hold in a softening environment. The 1% headwind from the federal shutdown is a reminder that demand can shift quickly based on factors outside any distributor’s control.

The embedded programs strategy, vending, implants, and supply chain integration, appears to be working. Those programs are growing faster than the company average and create stickier customer relationships. But they also require investment and execution discipline to scale.

For distributors watching from the outside, the MSC report offers a few takeaways. Pricing power is real but may not last indefinitely. Core customer focus and digital investment continue to pay off. And leadership transitions at major players often signal broader strategic recalibrations that ripple through the channel.

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

Leave a Reply